Understanding the Ethereum Merge and Its Significance

The Ethereum Merge represents a pivotal transformation for Ethereum, marking its transition to a proof-of-stake (PoS) consensus mechanism, one of the most eagerly awaited events in the crypto world.

The Merge signifies a leap from the traditional proof-of-work (PoW) framework to a PoS model, envisioned to enhance speed and energy efficiency dramatically. This monumental shift is not merely a simple switch but a multi-faceted and intricate process that demands meticulous planning and execution. This article unpacks the motivations behind the Ethereum Merge and the detailed stages that pave the way for Ethereum's evolution.

Contents

The Essence of Proof-of-Stake and Its Imperative Role

Diverging from the energy-intensive proof-of-work model, which pits miners against each other in a race to solve complex puzzles, proof-of-stake adopts a more eco-friendly approach. In PoS, validators are selected to create and verify blocks of transactions, based on the quantity of ETH they've staked and for how long they've held it.

In this innovative system, validators don't compete using computational power but are instead tasked with producing new blocks when chosen and affirming others' blocks when not. Validating a block of transactions opens the door for other network participants to attest to its legitimacy. Once a block receives a sufficient number of attestations, it is cemented into the blockchain. Rewards, in the form of ETH, are distributed by the network in relation to the size of each validator's stake. PoS also introduces a penalty mechanism, known as slashing, to discourage validators from any form of malpractice, like going offline or supporting fraudulent transactions.

The entry barrier to become a validator is high, requiring not only a substantial technical acumen but also a minimum of 32 ETH. For those unable to meet this requirement, joining a staking pool offers an alternative route to participate and earn rewards.

When compared to proof-of-work, the advantages of proof-of-stake are clear: it eliminates the need for costly mining setups, drastically cuts down on energy consumption, and reduces the risk of centralization, bolstering the network's security and resilience.

The Evolutionary Journey to the Ethereum Merge

The inception and progression towards the Ethereum Merge have been deeply rooted in the vision of Ethereum's co-founder, Vitalik Buterin. His advocacy for a proof-of-stake mechanism has been persistent, as documented in his numerous publications over the years. The switch from the current proof-of-work system to proof-of-stake is anticipated to dramatically decrease the network's energy consumption by at least 99.95%.

This monumental shift is also a foundational step towards the integration of shard chains, slated for deployment in 2023. Shard chains are anticipated to alleviate the current issues plaguing the network, such as data bottlenecks and exorbitant transaction fees, while also providing robust support for the emergent layer 2 scaling solutions. The Ethereum Foundation portrays shard chains as additional, cost-effective storage layers, which will greatly benefit applications and rollups by offering them a space to store data more efficiently.

Transitioning Ethereum’s core protocol is not a top-down mandate as seen in traditional corporate structures or as simple as implementing ERC standards. It demands a consensus from the distributed network of global nodes. This community-driven process ensures that any critical changes are not the result of hasty decisions but are the culmination of gradual, purposeful enhancements. The network has evolved through a series of methodical upgrades and forks that encompass several key developments: the Beacon Chain, the Merge itself, and the shard chains, all interdependent components that aim to achieve Ethereum's overarching goals of enhanced scalability, fortified security, and increased sustainability.

As of the latest updates, Buterin has indicated that the Merge is projected to occur in August. This event will signify the Beacon Chain, which currently oversees proof-of-stake operations, taking the reins completely from proof-of-work, marking a new era for Ethereum.

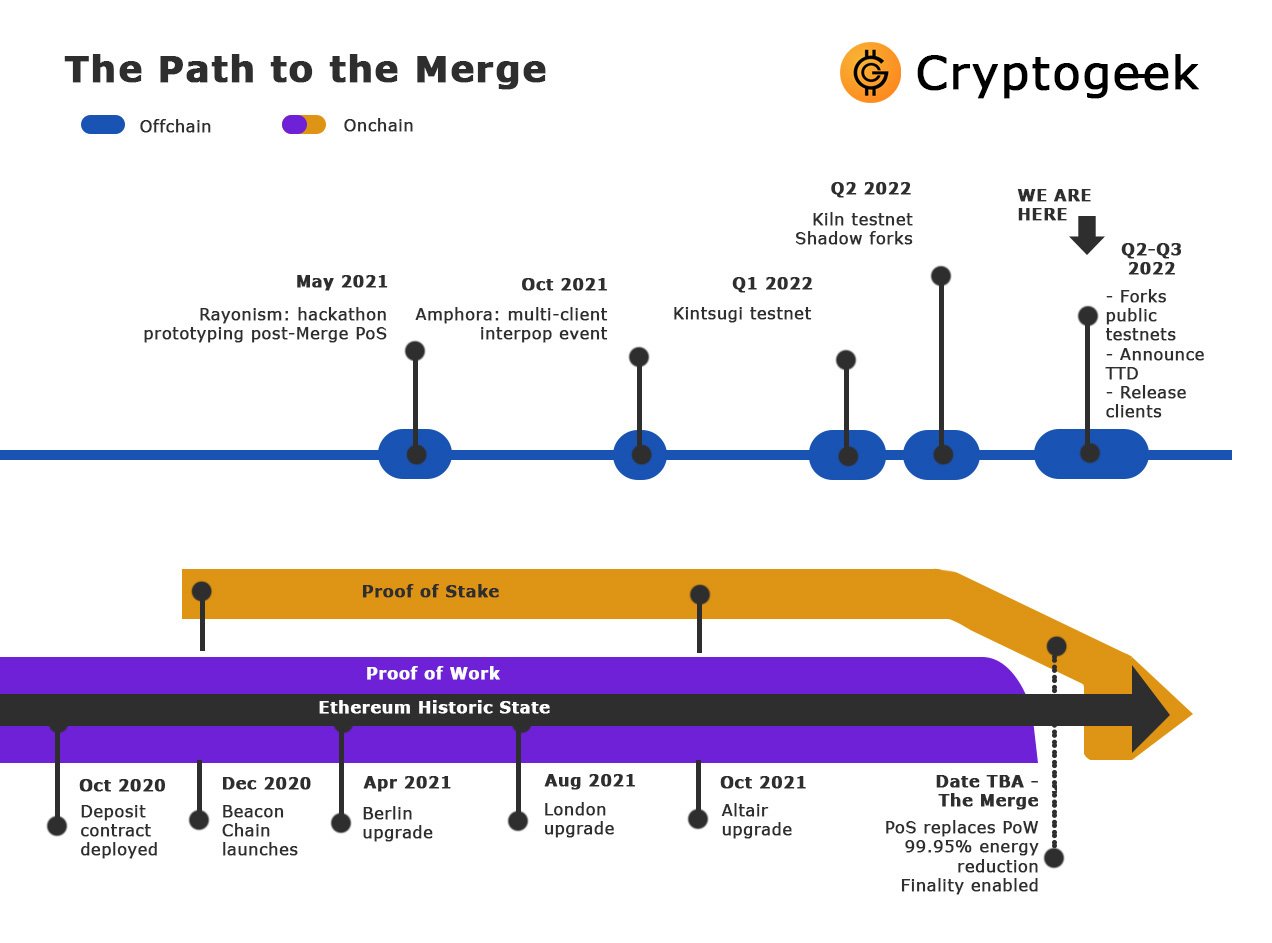

Path to the Ethereum Merge (Ethereum Foundation)

Charting the Beacon Chain's Pivotal Function in Ethereum's Evolution

Ethereum's journey towards a more efficient and scalable future is intricately linked with the Beacon Chain, a vital component in the network's shift to a proof-of-stake (PoS) mechanism. The Beacon Chain, also known as the consensus layer, is essential for integrating the existing Ethereum mainnet, still running on a proof-of-work (PoW) system, into a PoS-based framework.

Officially activated on December 1, 2020, the Beacon Chain functions parallel to the Ethereum mainnet. With a robust validator count exceeding 375,000, this chain is instrumental in managing the PoS consensus process. Beyond this, it lays the groundwork for Ethereum’s forthcoming phase of shard chain development, which promises to enhance the network’s abilities for data storage and scalability. Initially, the focus was to develop shard chains ahead of the Merge. However, the swift progression of layer 2 solutions like Arbitrum, Optimism, and Loopring shifted community priorities towards the Merge, deeming it more crucial to transition Ethereum to a PoS model first.

In the evolving landscape of Ethereum, the Beacon Chain is set to play an increasingly dynamic role, especially in coordinating the network’s shard chains and stakers. Currently, the Beacon Chain lacks the functionality to execute smart contracts or handle user accounts, which is why its amalgamation with the mainnet is a critical step. This merger will extend these vital capabilities to the PoS domain.

The forthcoming Merge marks a departure from Ethereum's historical DAO hard fork in 2016, a consequence of a significant security breach. Unlike the split that led to Ethereum Classic, the upcoming Merge will see Ethereum continue as a singular, unified entity, transitioning from PoW to PoS. This process is meticulously designed to preserve all transactional data, ensuring seamless continuity. The end of mining activities post-Merge is expected to encourage miners to transition towards staking, contributing to the validation process on the PoS-based Ethereum mainnet.

Chronology of Ethereum's Pivotal Upgrades and Forks

Ethereum's evolution, especially its transition to a proof-of-stake (PoS) model, has been marked by a series of significant software upgrades and forks, each requiring extensive testing and community collaboration to ensure stability and security. Here's a timeline highlighting key milestones since the Beacon Chain's inception:

London Hard Fork (August 5, 2021):

Post-Beacon Chain, the London hard fork emerged as a critical update influencing miner interactions and profitability on Ethereum. Key features included EIP-1559, which altered transaction fee mechanisms, and the “difficulty bomb” designed to eventually halt PoW block production. The EIP-3554, part of this fork, initially postponed the difficulty bomb to December 2021, which was further delayed by the Arrow Glacier upgrade.

Altair Upgrade (October 27, 2021):

The first major upgrade for the Beacon Chain, Altair, focused on backend improvements. While not affecting end users, it required node operators to update their software to remain compatible post-Merge and avoid penalties.

Arrow Glacier (December 9, 2021):

This network upgrade primarily extended the timeline of the “difficulty bomb” by several months, making it the sole focus of the update.

Ethereum Merge on Kiln Testnet (March 16, 2022):

A landmark event, the Kiln testnet merge, simulated the PoW execution layer merging with the PoS Beacon Chain. Despite some issues, including one client's failure to produce blocks, the test was largely successful.

Ropsten Testnet Merge (June 8, 2022):

Ropsten, the first of the three public testnets, successfully conducted a PoW to PoS merge. Post-fixes and reboots, the testnet saw a high participation rate and was deemed a success, paving the way for subsequent testnet trials.

Gray Glacier Upgrade (June 30, 2022):

Focused on the difficulty bomb, the Gray Glacier upgrade delayed it by approximately 700,000 blocks, targeting a September activation. No other changes were made in this upgrade.

Sepolia Testnet Merge (July 6, 2022):

The Sepolia testnet merge followed a two-step process involving updates to both the consensus and execution layer clients. This successful merge further reinforced the network's readiness for PoS.

Goerli Testnet Merge (August 10, 2022):

The final public testnet, Goerli, underwent a successful Merge practice run, transitioning to PoS following the Bellatrix upgrade to its beacon chain, Prater, activated on August 4.

Mainnet Shadow Forks 1-10 (Starting April 12, 2022):

Shadow forks, essentially simulated Merge tests on a small scale, were conducted to observe the PoW to PoS shift without impacting the actual network. After successful runs on testnets, these simulations were extended to Ethereum's mainnet, offering invaluable insights for the final Merge process.

Each of these steps represents a critical phase in Ethereum's journey toward a more sustainable, efficient, and scalable blockchain network, with the community's collaborative efforts playing a key role in navigating this complex transition.

What happens after the Merge?

In essence, the goal of the Merge is to expedite the process of moving from proof-of-work to proof-of-stake. To accelerate the transition, developers are working on reducing the features that may cause delay and temporarily inhibit the ability to withdraw staked ETH once the Merge is finalized. However, these will likely be addressed in a post-Merge "cleanup" upgrade.

Once the Merge is complete and Ethereum's newly adopted consensus layer takes on the role of adding new blocks to the Ethereum blockchain using the proof-of-stake consensus mechanism, developers will work on a few new phases they call the Surge, the Verge, the Purge and the Splurge. These will continue to make Ethereum's proof-of-stake blockchain more scalable and secure.

For example, while the Merge will not immediately solve challenges with scalability, it will help prepare the network for Ethereum’s version of subsidiary shard chains that will rely on a fully functional PoS network to operate. Through spreading the data load of the network across 64 blockchains, shard chains provide additional cheaper layers for applications and rollups to store data. They also enable layer 2 systems to offer low transaction fees while benefiting from the security of the Ethereum mainnet

Tutoriais principais

-

Что такое хард-форк?Jul 27, 2020

-

Стейкинг на Ethereum 2.0 и его основные особенностиAug 01, 2020

-

Инновации на основе блокчейна в сфере энергетикиAug 03, 2020

contact Maria Renee FX,

via Ema… mariarenee820@gmail.com

Also her WhatsApp contact: +1(732)630-9483, Telegram: @Mariarenee820