XRP News Prediction: Ripple's Future Trends

XRP news prediction is increasingly becoming a popular subject as investors and fans want to see what the future of Ripple's digital currency holds. We will examine the drivers of XRP prices, analysis by experts, and the tools that provide consistent indicators. Whether you are a novice with cryptos or have followed markets for decades, knowledge of XRP news prediction can help inform your actions. We will begin with an explanation of basic concepts and then look at history, technology, actual case studies, and tools used to predict XRP's direction.

Contents

- Defining XRP and News Prediction

- Why XRP Predictions Matter

- Historical XRP Price Trends

- What Affects XRP Price

- Technology Underlying XRP Ledger

- Real-World Examples of XRP Forecasts

- Major Players Influencing XRP Predictions

- Methods and Tools Used for Making XRP Predictions

- Assessing Prediction Data

- Conclusion

- FAQ

Defining XRP and News Prediction

XRP is a digital currency issued by Ripple, which is a firm specializing in quick cross-border payments. XRP is different from other tokens in that it does not use energy-intensive mining. XRP's ledger settles transactions in seconds with low fees. The speed of the transactions makes XRP a viable contender for cross-border transfers.

News forecasting is the act of predicting future price movement by using information, expert opinion, and past trend. Crypto prediction tends to combine technical charts, metrics from the blockchain, and media sentiment. For XRP, prediction also involves the controversy surrounding Ripple's lawsuits and alliances.

By establishing those concepts, we lay the foundation for more in-depth discussion. Understanding what XRP does and what prediction is enables you to digest the later sections discussing methodology and case studies.

Why XRP Predictions Matter

Have you wondered why certain predictions are accurate and others are off the mark? For XRP investors, good forecasts can alert them to make their purchases or sales. Markets tend to move quickly in response to large headlines, like updates from the courts or banking transactions.

Good forecasts can protect you from unexpected plunges induced by news events. For instance, a surprising court ruling regarding Ripple's securities designation created 2023's price fluctuations. People who heeded solid analysts' advice could rebalance their positions ahead of the market turning.

Apart from individual profits, solid projections promote broader adoption. Banks that pilot Ripple's payment corridors seek stability. Credible forecasts establish trust in the use of XRP as a bridge currency.

Historical XRP Price Trends

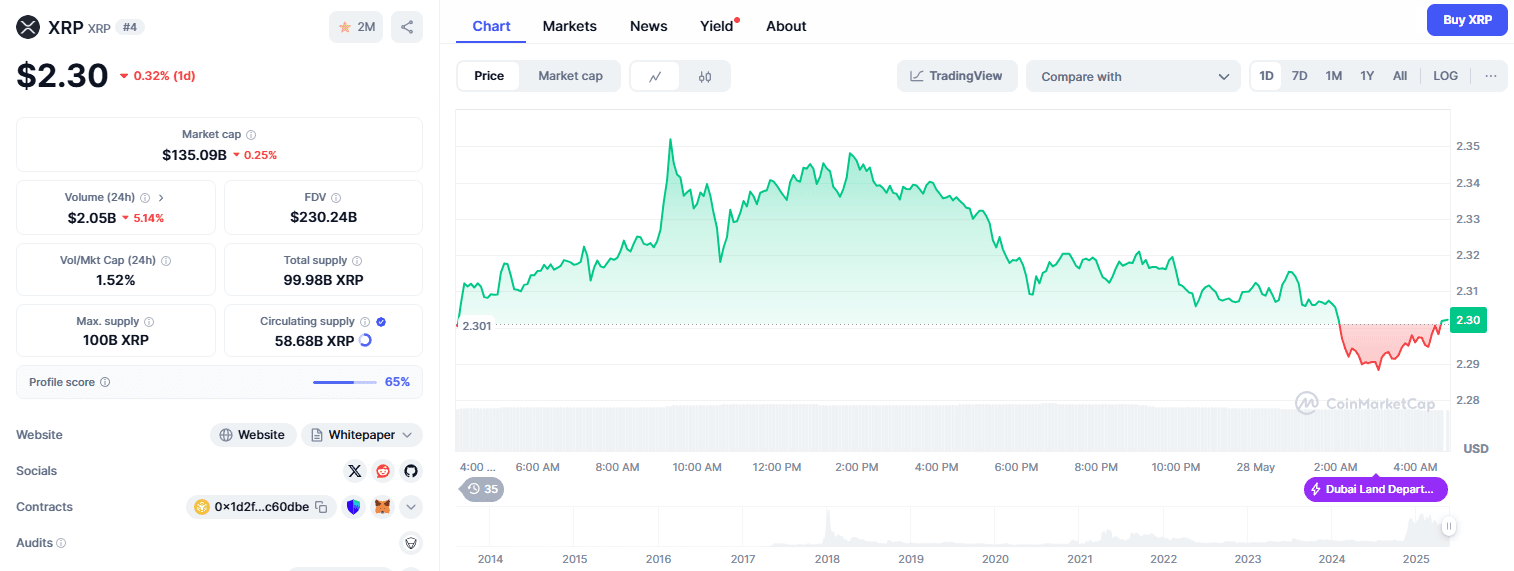

Reflecting also helps you notice patterns that can happen again. In late 2017, the price of XRP went from a couple of cents to more than $3 during the broader crypto boom. Then it dropped below $0.30 when the markets declined in 2018.

In 2020, Ripple introduced On-Demand Liquidity (ODL), which settles immediately using XRP. The announcement boosted the token by a small amount, driving it up over $0.60 for a short period. However, the Securities and Exchange Commission of the U.S. sued Ripple in December 2020. The actions reduced XRP by more than 70% in a single month.

Guiding dates—such as ODL launches and court rulings—illustrate how news affects XRP's price. Observe the events to receive cues on reactions yet to happen.

What Affects XRP Price

It is used for cross-border transactions.

First, regulatory clarity is a huge factor. If courts or agencies declare that XRP is not a security, it may unlock the doors for more listings and institutional usage. Conversely, adverse rulings might curtail support from major exchanges.

Second, payment providers can drive demand through adoption. Businesses that utilize ODL include XRP in their treasury when settling trades. Expansion in such a network can increase the demand for tokens.

Third, macro finance and crypto trends impact XRP. When Bitcoin and Ethereum are rising, the altcoins such as XRP tend to follow the up move. When there are sell-offs across the markets, XRP can fall even when its news is neutral.

Understanding all of this helps you realize why varying analysts put different weights on things when making forecasts.

Technology Underlying XRP Ledger

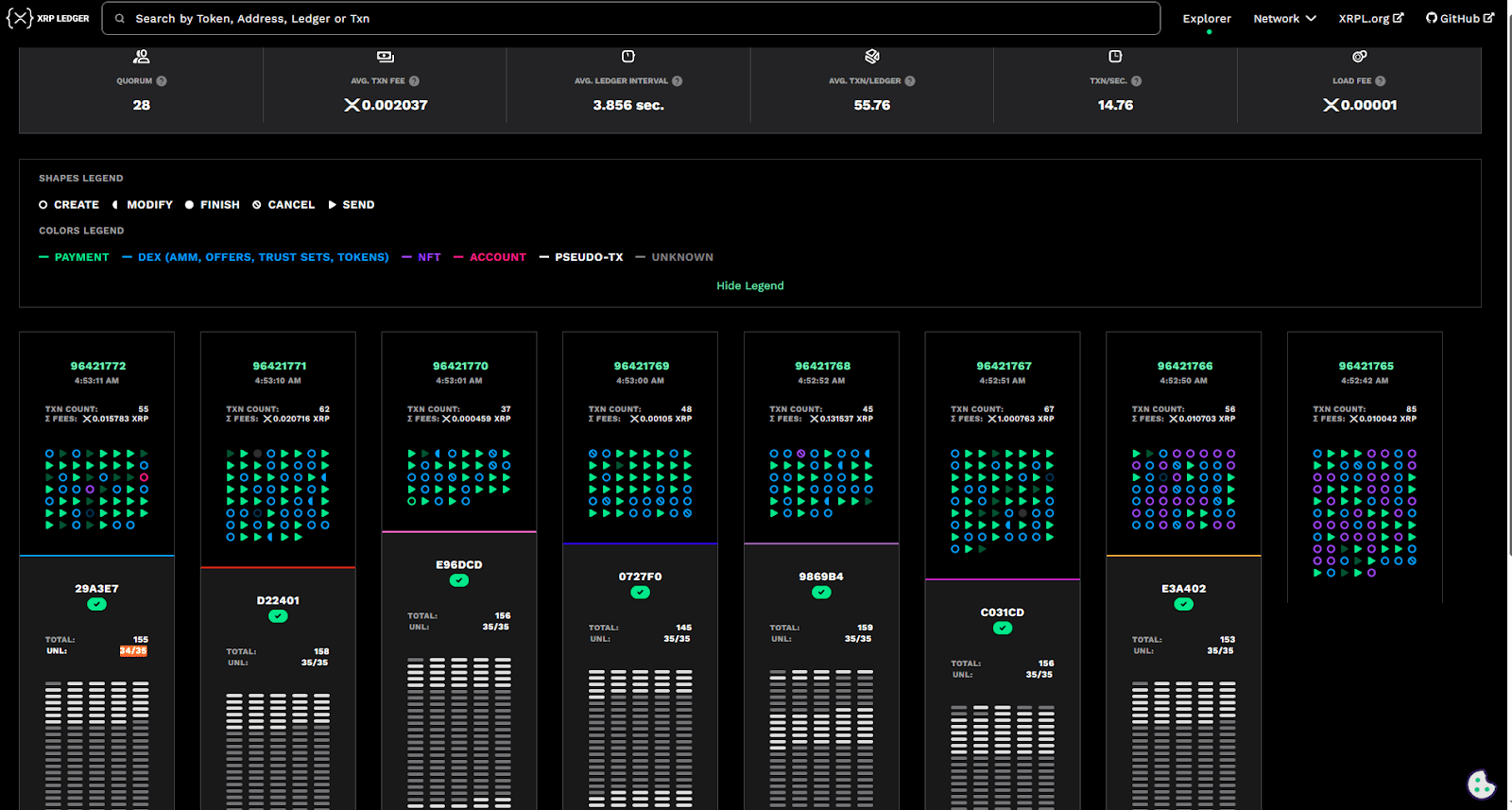

The XRP Ledger employs a consensus algorithm by which validators validate transactions by proposals. The approach precludes excessive energy consumption with finality times of three to five seconds. All validators are required to maintain a Unique Node List establishing trusted peers.

Relative to proof-of-work chains, XRP's system enables it to scale with low expenses. The 1,500 transactions per second the ledger can process outclass most blockchains. Small transactions with low fees—frequently fractions of a cent—are reasonable.

To review technical health, look at the amount of active validators, the growth of the ledger size, and the volume of transactions. They frequently appear in forecasts as indicators of usage of the network.

Real-World Examples of XRP Forecasts

In mid-2021, a well-known analyst predicted XRP would hit $2 if Ripple won its case. When news in July 2021 hinted at a partial win, price jumped nearly 50 percent. That event shows how legal updates can validate forecasts.

Another instance was the one in March 2023. A fintech company said it had joined the network of Ripple, with experts predicting a 20 percent increase. The actual action was more subdued and indicated that not all news of partnerships is created equal.

By looking at such instances, you find out which kind of news brings large movements and which have lesser implications. This knowledge sharpens your personal forecasting model.

Major Players Influencing XRP Predictions

Various parties impact XRP predictions. Crypto news sources such as CoinDesk and The Block print analysis and interviews. These articles tend to influence market sentiment.

Independent analysts also post target prices on social sites. Some are rational in their approach—based on on-chain data and charts—others are following hype. Reviewing track records will lead you to believe the credible voices.

The company itself posts updates in its blog and financial reports. If not necessarily direct forecasts of prices, the posts do outline corporate plans and new transactions. Overlaying those plans onto a model of prices completes your picture.

Methods and Tools Used for Making XRP Predictions

Charting sites like TradingView allow you to use indicators such as a moving average and an RSI. The indicators identify trend and overbought or over-sold regions. Basic cross-over signals can be used as entry or exit points.

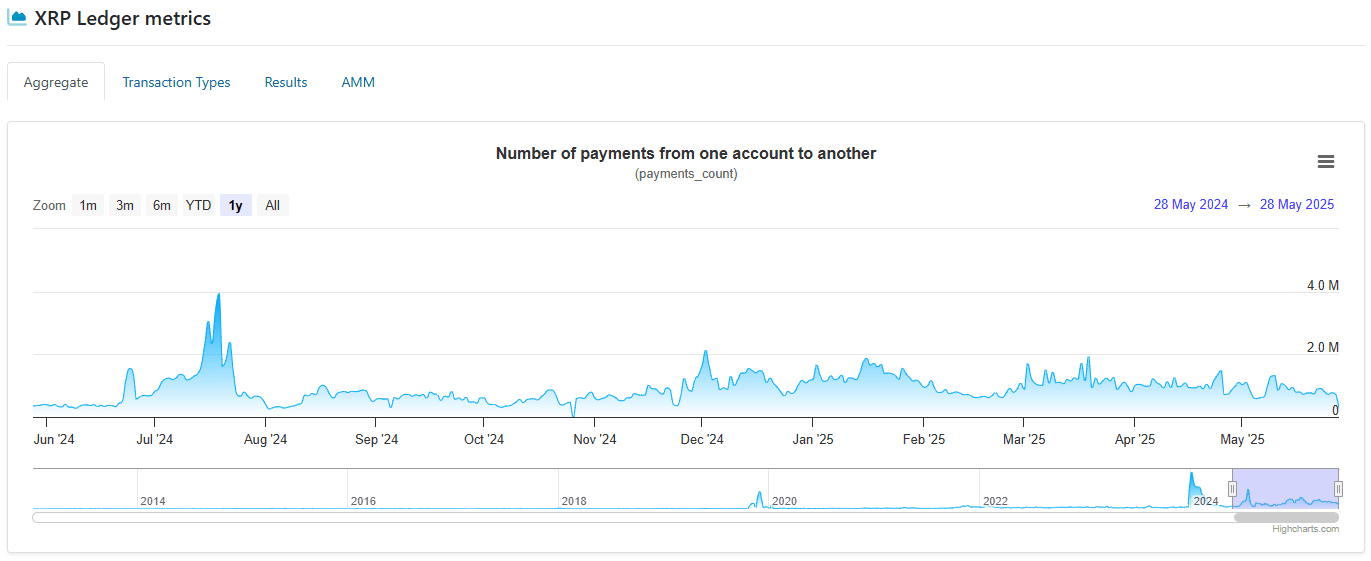

Online metrics such as XRPScan indicate token transactions between pockets. Large deposits to exchange wallets can be a sign of sell pressure, with outgoing transactions typically an indicator of holding intent.

Sentiment analysis tools monitor tone and mentions on social media. If sentiment is trending positive with a partnership, the stock's price might follow. Be careful with false alarms, though—bots can swell the figures.

Combining chart, chain, and sentiment analysis, you create a multi-faceted view that is superior to a single approach.

Assessing Prediction Data

Whenever you read a prediction, ask the following questions: What evidence is there for it? Is it based on a one-off item of news or many variables? How is the accuracy of the forecaster?

Always make sure a source quotes numbers such as percentage of lip requests, number of transactions, or search volume surges. Pure opinion without figures fails.

Back-test against previous news events. If the model called the moves over the past year, then it will probably pass the test. But continually update inputs—markets change and new variables are discovered.

Conclusion

XRP news prediction uses history, technology, statistics, and expert opinion. If you understand how courts, partnerships, and network quality influence value, you can make well-balanced forecasts. Use charts, on-chain indicators, and sentiment tools together. Constantly challenge sources and monitor outcomes. The combination is your best opportunity to catch buy or sell signals with Ripple's token.

FAQ

What is XRP news prediction?

XRP news prediction uses data and expert views to forecast price moves based on events like court rulings or partnerships. Analysts combine chart patterns, token flows, and sentiment signals to make calls.

Which events move XRP prices most?

Legal updates on Ripple’s case in the U.S., large partnerships using On-Demand Liquidity, and listings on major exchanges tend to have the biggest impact. Macro swings in Bitcoin or Ethereum also play a role.

How accurate are XRP forecasts?

Accuracy varies by method and data quality. Models that mix multiple inputs—charts, on-chain metrics, and social sentiment—often outperform single-factor approaches. Yet no forecast is certain.

Can I rely on social media analysts for XRP predictions?

Some analysts share solid research, but others chase hype. Check an analyst’s history and whether they back calls with real data. Trust sources that explain their methods.

What tools help with XRP prediction?

TradingView for chart indicators, XRPScan for token transfers, and sentiment platforms for social mentions are common. Combining these tools gives a broader view and reduces blind spots.

인기 튜토리얼

-

Что такое хард-форк?Jul 27, 2020

-

Стейкинг на Ethereum 2.0 и его основные особенностиAug 01, 2020

-

Инновации на основе блокчейна в сфере энергетикиAug 03, 2020

땟글이 없습니다. 첫 땟글 쓰십시오!