Optimizing Digital Asset Trades with Crypto Trading Bots

Crypto trading bots have emerged as essential instruments for traders navigating the complex and ever-active cryptocurrency market. These automated systems are not just for the trading elite; they level the playing field, offering both novice and seasoned investors the chance to employ sophisticated algorithmic trading strategies.

The cryptocurrency market is notorious for its volatility and operates 24/7, presenting a plethora of trading opportunities that human traders can miss. This is where crypto trading bots step in, providing a solution to human limitations. They are programmed to perform trades based on predefined criteria, executing transactions with speed and efficiency that is virtually impossible to match manually.

This comprehensive guide delves into the intricacies of crypto trading bots, examining their mechanisms, advantages, limitations, and even provides a glimpse into some of the popular bots in the market. Whether you’re just starting out or looking to refine your trading approach, understanding the role of these bots can significantly enhance your trading strategy in the cryptocurrency arena.

Contents

- Insights into Automated Cryptocurrency Trading Mechanisms

- The Inner Workings of Cryptocurrency Trading Automatons

- Evaluating the Benefits and Drawbacks of Cryptocurrency Trading Bots

- Pros of Automated Crypto Trading Assistants

- Cons of Automated Crypto Trading Assistants

- Spotlight on Leading Automated Crypto Trading Solutions

Insights into Automated Cryptocurrency Trading Mechanisms

Cryptocurrency trading bots stand as cutting-edge algorithmic solutions programmed to execute trades within the dynamic crypto asset market. These bots are engineered to function without interruption, bridging the gap between human trading capacity and the non-stop nature of the crypto market, to secure the most favorable trading positions.

The array of strategies that these automated tools can implement varies widely, with some traders crafting bespoke bots to take advantage of market anomalies.

The Inner Workings of Cryptocurrency Trading Automatons

These digital trading aides are crafted by specialized software entities and are available through various acquisition methods including direct purchase, subscription models, or as free software offerings. Utilizing these bots effectively often requires a basic literacy in programming and a grasp of analytical market strategies.

Crypto trading bots engage with digital currency exchanges via an Application Programming Interface (API), which acts as a digital intermediary. This connection allows the bots to autonomously execute trades and maintain the trader's portfolio.

These virtual traders operate based on a set of user-defined indicators and parameters, which can span from elemental factors like pricing and volume to intricate technical indicators such as moving averages and the relative strength index (RSI). The precision of these settings is pivotal, as they steer the bot's scrutiny of market conditions and its trading actions. When market trends align with the trader’s specified parameters, the bot springs into action, executing trades.

Given that trading bots have immediate access to one's cryptocurrency investments and the power to make autonomous trades, it's vital to impose stringent restrictions on your API's capabilities and engage only with bots from reputable sources. Moreover, backtesting your strategy across diverse market conditions is essential to enhance its efficacy in live trading scenarios.

Evaluating the Benefits and Drawbacks of Cryptocurrency Trading Bots

The appeal of cryptocurrency trading bots is evident in their numerous advantages, yet they come with their own set of intricacies and potential pitfalls. We will explore the benefits and drawbacks to give you a comprehensive understanding of the use of trading bots in your investment strategy.

Pros of Automated Crypto Trading Assistants

Crypto trading bots streamline the trading experience by automating operations, which allows for simultaneous oversight of multiple digital assets and markets. This automation spares traders the exhaustive task of manual monitoring.

These bots provide the advantage of constant trading within the volatile crypto market. Human traders have limitations — they cannot monitor markets every hour of the day, risking missed opportunities that trading bots can capture.

With proper configuration, crypto trading bots can achieve superior trading precision and timing. In a market that's sensitive to timing and currency selection, bots can enhance profitability.

Crypto trading bots also offer the benefit of emotion-free trading, reducing errors. Human traders can be influenced by emotional responses, leading to potentially detrimental trading decisions.

Cons of Automated Crypto Trading Assistants

For a trading bot to function, it must remain active, which means your computing device must also be operational continuously. Despite automation, there's a risk of system failures or execution lapses, necessitating occasional supervision.

The setup process for a trading bot can be complex, often requiring a solid understanding of both trading strategies and the nuances of the cryptocurrency market. Given the market's volatility, strategy adjustments are frequently necessary, and a bot's effectiveness hinges on its programming quality.

Allowing a trading bot access to your digital assets introduces an element of risk, particularly of malicious activities. Trading bots could potentially be programmed with hidden code designed to siphon funds. It's crucial to conduct thorough research and select a reliable and secure source for your trading bot software.

Spotlight on Leading Automated Crypto Trading Solutions

The marketplace is teeming with a variety of automated crypto trading bots, each offering unique features and requiring different levels of user interaction. Here's a closer look at some top-tier crypto trading bots currently making waves in the market.

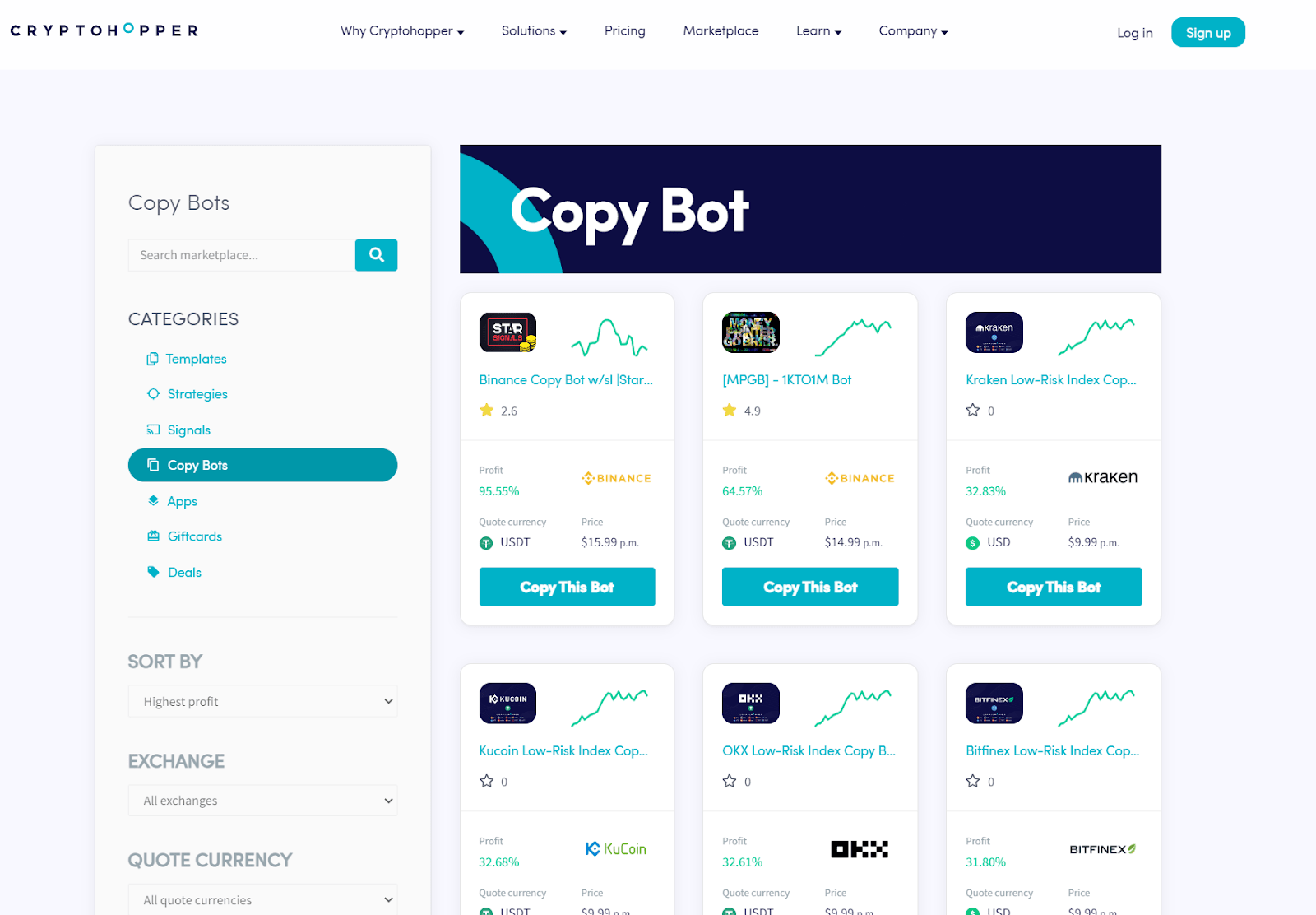

Cryptohopper

Cryptohopper presents itself as a versatile cloud-based trading platform, functioning on a subscription basis and initiating with a complimentary 7-day trial period. This platform empowers traders to implement their chosen strategies and even incorporates external trading signals. Featuring an array of strategic options, indicators, and candlestick patterns, Cryptohopper is equipped to trade a multitude of cryptocurrencies.

Cryptohopper Copy bots

Coinrule

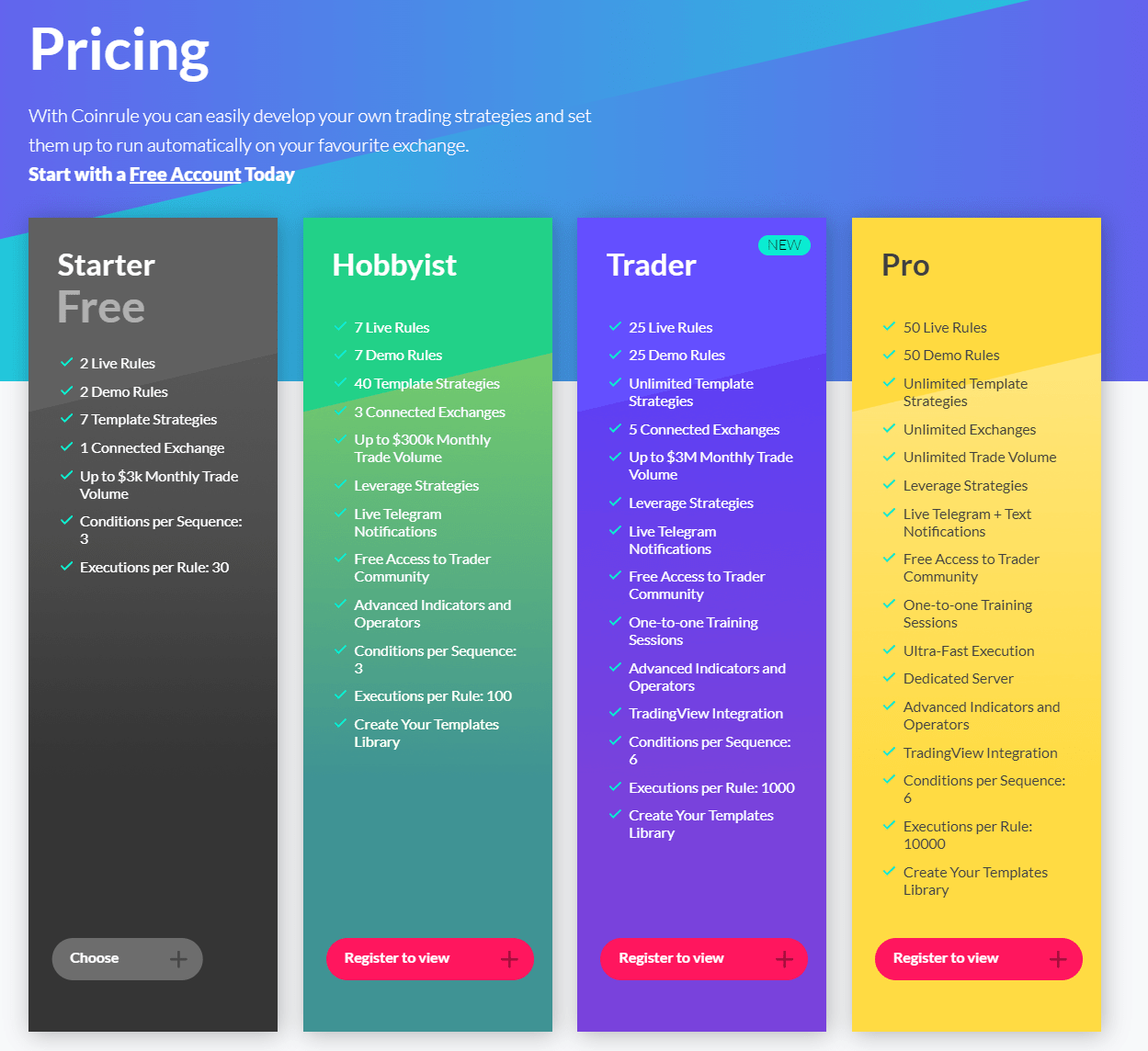

With a repository of over 200 pre-built trading strategy templates, Coinrule stands out as a user-friendly automated trading bot provider. It boasts a risk-free demo mode to safely experiment with strategies before live implementation. Coinrule's service tiers range from complimentary to various paid subscriptions, each offering access to a specific number of strategic templates and a coin scanner that monitors pricing movements across an extensive portfolio of cryptocurrencies.

Plans of Coinrule accounts

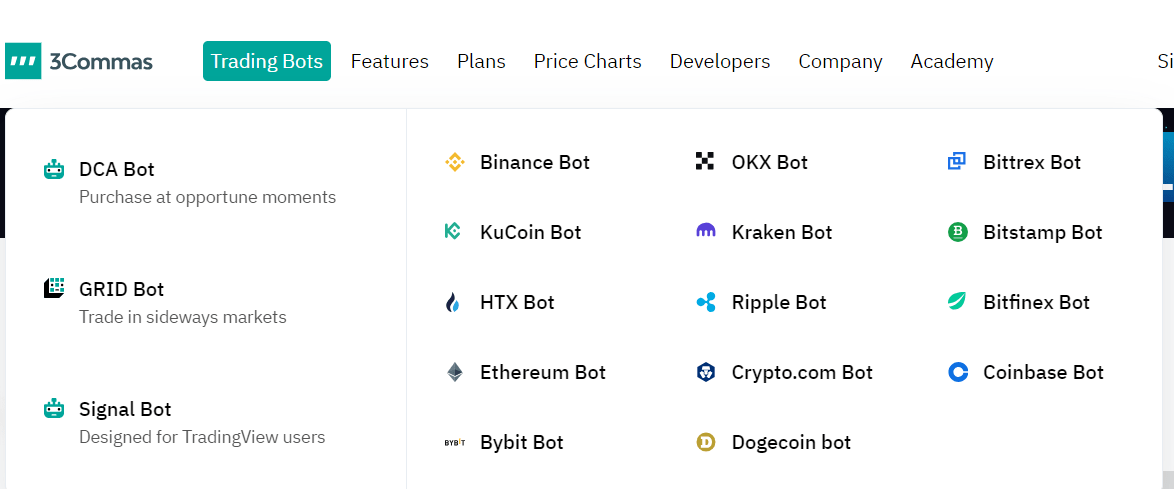

3Commas

3Commas offers a comprehensive trading platform with customizable crypto trading bots tailored to align with any market condition. Users can either construct their strategies or replicate successful techniques from seasoned traders. 3Commas categorizes its offerings into a three-tier subscription model, starting with a basic free plan.

3Commas Trading bots

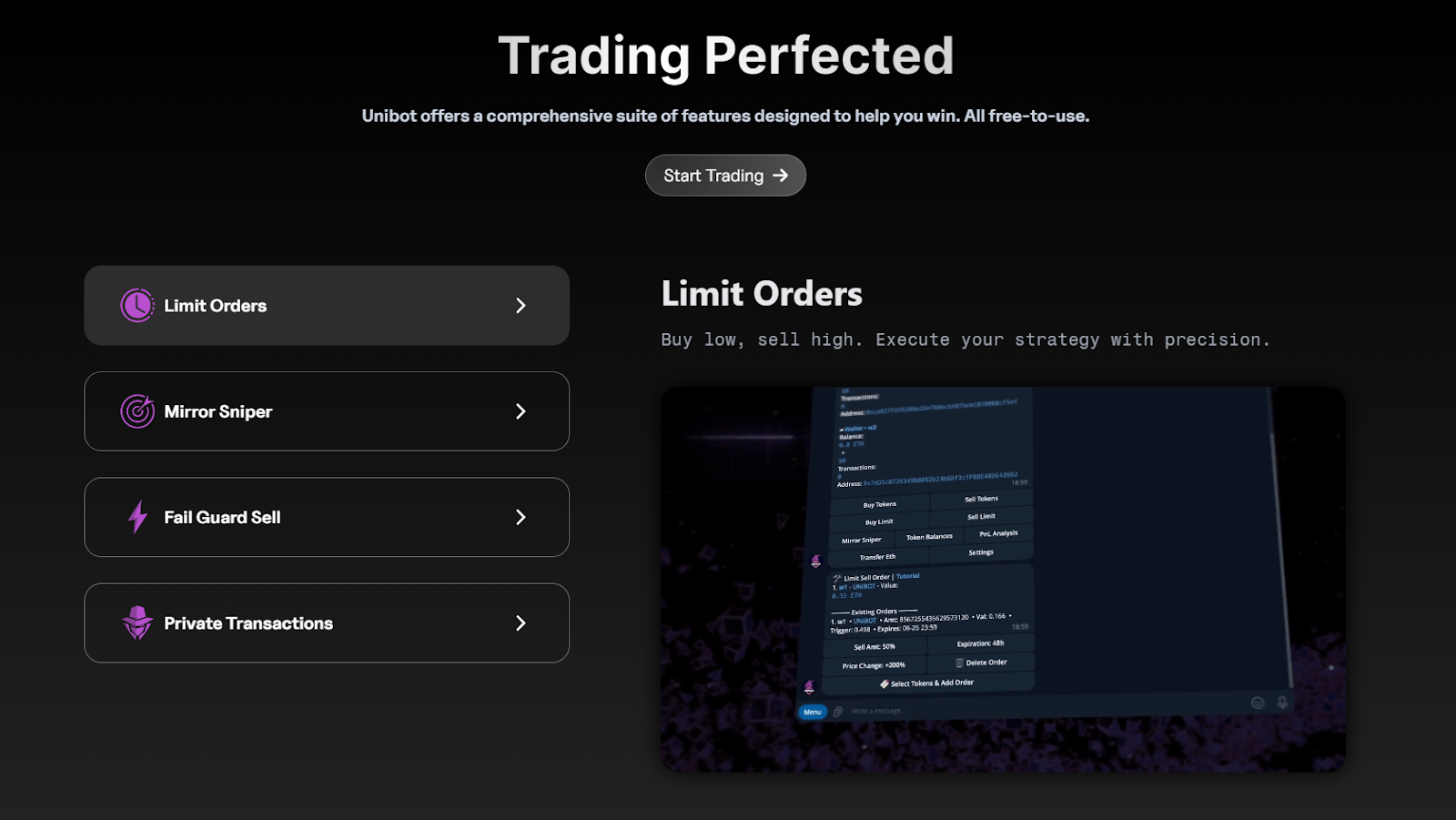

Unibot

Unibot, a novel Telegram-based trading bot, simplifies the process of trading cryptocurrencies by integrating directly with the Telegram app. Operating within the DeFi ecosystem, Unibot facilitates swift trading on Uniswap v3. It also introduces its native token, UNIBOT, which grants holders benefits like governance participation, yield farming perks, and decreased transaction fees. Additionally, Unibot provides features such as managing multiple wallets, mirroring trades, and immediate access to newly launched tokens.

Unibot Features

While crypto trading bots offer numerous advantages for adept traders desiring to automate their strategies, it's critical to acknowledge that they are not autonomous profit generators. Effective use of a trading bot requires the implementation of a well-researched and frequently adjusted strategy. Even with diligent monitoring and backtesting, profitability is not guaranteed in the ever-fluctuating world of crypto trading.

인기 튜토리얼

-

Что такое хард-форк?Jul 27, 2020

-

Стейкинг на Ethereum 2.0 и его основные особенностиAug 01, 2020

-

Инновации на основе блокчейна в сфере энергетикиAug 03, 2020

You can deposit money n trade

When u wanna withdrawal ur money they seem to reject

Which mean u can accumulate ur asset on their page but u can’t take ur money out

I was able to get my funds back through the assis tan ce of Gavinray he placed a recovery of MY funds and I got all that was held on his mail gavinray78@gmail.com or WhatsApp +1 352 322 2096

It's unfortunate that many fell victim to these scam platforms. Thankfully, was able to resolve the issue by reporting to Westinghousef.com. Their assistance in recouping our investments was invaluable. Grateful for their support during a challenging time. do mention Sally as it will give preferntial treatment

contact Maria Renee FX,

via Ema… mariarenee820@gmail.com

Also her WhatsApp contact: +1(732)630-9483, Telegram: @Mariarenee820