MEXC Futures: The Ultimate Guide to Crypto Futures Trading

MEXC Futures is a trading feature on MEXC trading platform that allows traders to trade cryptocurrency futures contracts. It is a type of trading that allows traders to profit from both rising and falling markets. Let's dive into MEXC Futures platform, its key features, functionality, pros, as well as risks of trading futures on MEXC in this post.

Contents

What is MEXC Futures?

MEXC Futures is a segment on the MEXC trading platform dedicated to trading cryptocurrency futures, which are traded by users on this platform. Users may speculate on cryptocurrencies, including altcoins, Ethereum, as well as even Bitcoin, using cryptocurrency futures contracts without actually owning the underlying asset. Futures contracts themselves are agreements for buying or selling a particular asset on a particular date and time in the future, at a particular cost. With trading futures, traders even utilize leverage on positions, magnifying both potential profit as well as loss.

MEXC Futures has two types of contracts, namely, USDT-margined futures and coin-margined futures. Professionals as well as traders who aim to diversify trading strategies favor futures trading on the platform.

How MEXC Futures Works

MEXC Futures operates on leverage, where a trader trades a smaller initial deposit so as to manage a large position. The amount of leverage utilized is a factor of both traded asset and what is available on the platform at a particular moment.

MEXC Futures, in short, works as follows:

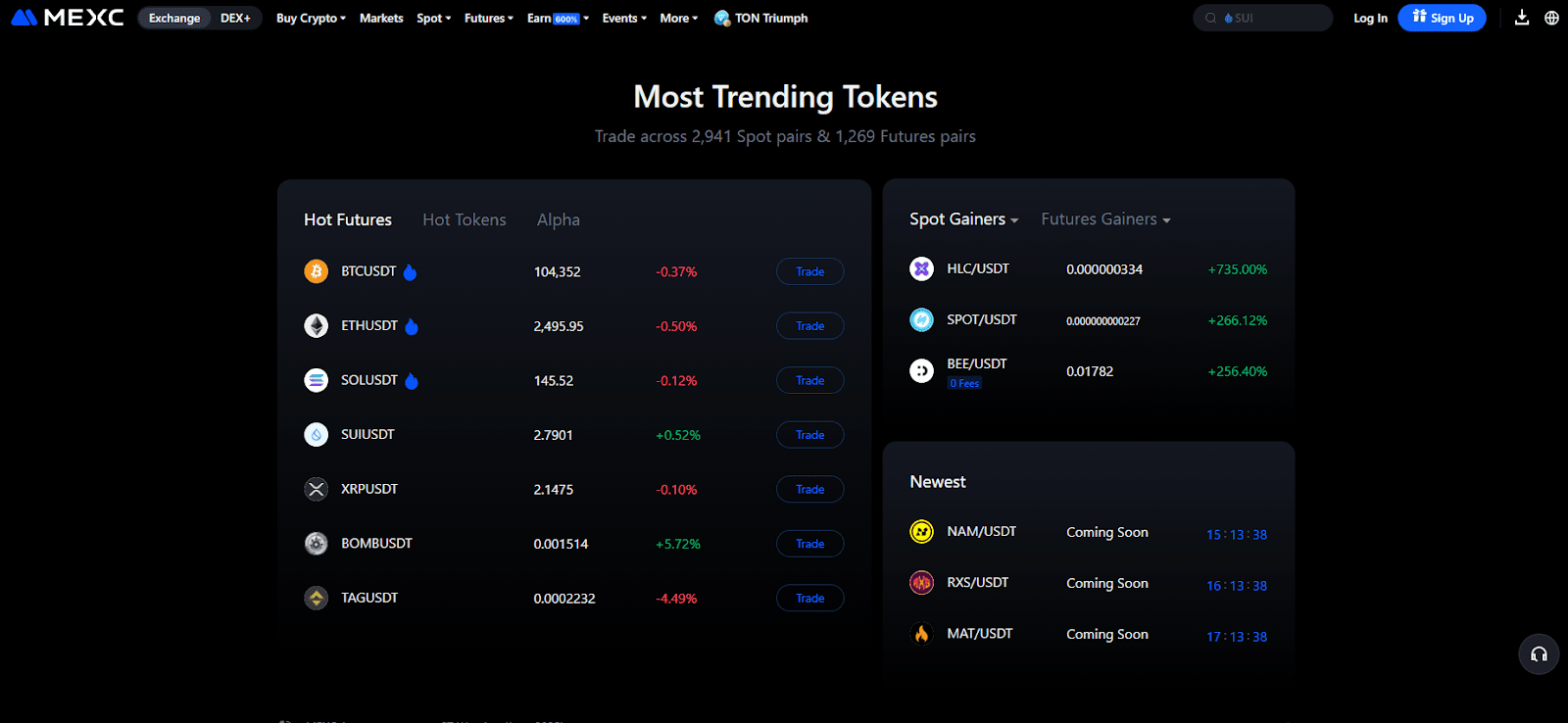

- Choose a Crypto Pair: The traders have a long list of cryptocurrencies from which they can choose for future trading. While popular cryptocurrency pairs, BTC/USDT and ETH/USDT, are traded daily, MEXC offers a long list of available cryptocurrencies.

- Leverage: The use of leverage allows traders to borrow funds in order to magnify the magnitude of positions taken. Taking a position of say, $10,000, on a trading platform that has a leverage of 10x would only require a person to use a mere $1,000 of their own funds. However, it escalates both gains and losses as well.

- Open a Position: Once a cryptocurrency pair is decided on by a trader and they have applied the level of leverage they wish, they can open a position. The position is long, where they wager a rise in price, or short, where they wager a decline in price.

- Settlement: MEXC futures contracts are subject to expiry dates. The traders must close their positions in front of contract expiry or have them settle automatically by the platform. Upon settlement, the difference between both the entry as well as closing cost determines a profit or loss for the trader.

Principal Features of MEXC Futures

MEXC Futures has a variety of tools and features that help traders delve into the field of cryptocurrency futures trading:

- Leverage Options: One of the best of MEXC Futures is leverage options. The traders have a number of leverage options, and a number of the pairs accommodate a leverage of up to 125x. This is useful in helping traders increase their exposure in price action in the markets.

- Real-Time Data and Charts: MEXC Futures avails real-time data, including charts of prices, order books, as well as market depth, for traders to make informed trading decisions. The platform also has technical analysis tools for use in predicting directions of prices.

- Risk Management Instruments: MEXC Futures also comes with several risk management instruments such as stop-loss as well as take-profit orders. These instruments allow traders to limit potential losses as well as take advantage of profits at a predefined level.

- Easy-to-Use Interface: The MEXC Futures platform is simple to use, featuring a simple-to-understand interface which is easily navigated by both professionals and newcomers who can quickly access advanced functionality and trade without delay.

- 24/7 Trading: The cryptocurrency markets, including MEXC Futures, trade 24/7, which is a departure from conventional stock markets. Therefore, traders are continually taking positions on any movement in the markets, day or night.

- Low Costs: MEXC has favorable trading fees, which are useful for traders aiming to pay as little as possible for trading. The site charges several levels of discount on fees for trading by volume or by holding MEXC tokens (MX).

MEXC Futures Contract by Type

MEXC offers two main types of futures contracts for traders:

- USDT-Margined Futures: These contracts settle in Tether or USDT, a stablecoin, which is pegged against the US dollar. The advantage of trading in USDT-margined futures is that the contract value is stable, and traders don't have to worry about fluctuations in the value of collateral in terms of USDT.

- Coin-Margined Futures: The contracts settle in the underlying cryptocurrency, for example, Bitcoin (BTC) or Ethereum (ETH). Coin-margined futures tend to be more volatile, as the collateral value varies with cryptocurrency cost.

Both contracts allow traders to earn returns in both up-trending and down-trending markets. The difference lies in choosing between coin-margined and USDT-margined futures, which is determined by the trading strategy as well as risk tolerance of a trader.

Benefits of MEXC Futures Trading

There are several advantages when trading on MEXC Futures platform:

- Leverage: The application of leverage for trading is a major benefit in futures trading. With a small outlay for capital, large positions can be held by traders, and they have a high potential return.

- Market Versatility: MEXC Futures serves long as well as short positions, thereby allowing traders to earn returns in both bull and bear markets. It therefore serves as a multipurpose trading platform for all markets.

- 24/7 Access: The cryptocurrency markets are very volatile, and MEXC Futures allows traders to take advantage of changes in prices at any time of day. This is a key feature for active traders.

- Advanced Features: MEXC Futures boasts advanced features such as stop-loss and take-profit orders, which allow traders to manage risk as well as book profits automatically.

- Wide Asset Coverage: The site covers a wide number of cryptocurrency pairs for futures trading, giving traders a large number of options for diversifying portfolios.

Risks in MEXC Futures Trading

Although there are several advantages in trading on MEXC Futures, it is necessary to know the risks involved:

- Leverage Risk: The leverage magnifies loss as well as profit. If it goes against a trader, loss may be in excess of the initial cost, which leads to a margin call or liquidation of a position.

- Market Fluctuations: The cryptocurrency markets are highly fluid, which can lead to unexpected and fast changes in price. While there can be opportunities in this, there is a high risk of making large losses.

- Liquidation Risk: If a leveraged position loses value by sufficient, it can be liquidated to cover the margin. This can result in a total loss of investment.

- Complexity: Futures trading is a complex type of trading as compared to spot trading, and it is not appropriate for newcomers or freshers. The traders must be well aware of futures contracts, risks, and strategies to succeed in this trade.

Conclusion

MEXC Futures is an excellent cryptocurrency trading platform involving leverage with a possibility of earning on bear as well as on bull markets. The site is blessed with high-class tools but is quite easy to navigate, making it a platform for both amateur and professional traders. However, trading in futures is a risky undertaking, moreover when trading on high leverage, and traders should understand all risks involved in trading here beforehand.

Just as in all trading, MEXC Futures trading requires thorough analysis, control of risks, and an understanding of trends in markets. With the sophisticated tools and instruments available from the site, traders can enhance chances of successful trades while capping potential losses.

FAQ

What is MEXC Futures?

MEXC Futures is a platform for cryptocurrency derivatives trading, allowing users to buy and sell futures contracts with leverage. The contracts allow traders to speculate on cryptocurrencies' directions without actually owning the underlying asset.

What is leverage in MEXC Futures?

Leverage allows traders to trade on a large position size using a smaller amount of capital. For example, through a 10x leverage, a trader is able to trade a position of $10,000 using only $1,000 in capital.

Is MEXC Futures for beginners?

While MEXC Futures is pleasing on the eye, trading in futures is riskier than spot trading and not suited for newcomer traders. You should be aware of how futures contracts work and how risky they are before trading.

What is the risk of MEXC Futures?

Major risks of MEXC Futures include significant losses due to leverage use, market changes, and liquidation. It is important for traders to be cognizant of these risks and use relevant risk management strategies.

Does MEXC Futures offer non-KYC trading?

Although it is possible to open an account and trade on MEXC without verification of KYC, verification is required in order to have access to enhanced withdrawal limits as well as advanced trading functionality.