When Will XRP Explode? In-Depth Analysis and Future Perspectives

When will XRP explode? It is a question that still reverberates throughout the cryptocurrency space. XRP, the cryptocurrency developed by Ripple Labs, has been the source of controversy for investors, speculators, and blockchain enthusiasts for quite a long time now. With the constantly evolving landscape of the crypto market, numerous individuals are anxiously awaiting whether and when XRP will experience a surge in value and use. This article takes an in-depth, clear-eyed examination of the variables that would determine XRP's future and what would actually need to occur for an "explosion" to occur.

Contents

- Introduction to XRP and the Meaning of ‘Explode’

- A Brief History of XRP

- How XRP Works: Key Technology and Principles

- Notable Parties and Entities Collaborating with XRP

- Significant Events Driving XRP's Price and Adoption

- Studies and Forecasting: What the Experts Say?

- What Needs to Happen for XRP to ‘Explode’?

- Risks and Challenges of XRP

- The Community and Ecosystem Surrounding XRP

- Conclusion

- FAQ:

Introduction to XRP and the Meaning of ‘Explode’

Let's establish some fundamentals. XRP is a virtual currency that has been designed by Ripple Labs, and its primary use is for speedy and cheap cross-border settlements. When individuals refer to the question of when XRP will explode, they are normally asking when its value will spike, or when mass adoption will occur. Its explosive increase could be caused by a significant legal victory, new alliances, or the transformation of the world's financial infrastructure.

Understanding these factors will enable us to make sense of the speculations regarding XRP's prospects. In order to gain clarity, we must refer to the history, the tech, the current status, and the major players that are impacting XRP.

A Brief History of XRP

XRP was introduced in 2012 by Ripple Labs, with the goal of fixing problems in international money transfers. Many conventional banks use time-consuming, costly mechanisms such as SWIFT. Ripple wanted to provide a faster, less costly solution. XRP is a bridge currency, enabling the flow of money through borders in seconds.

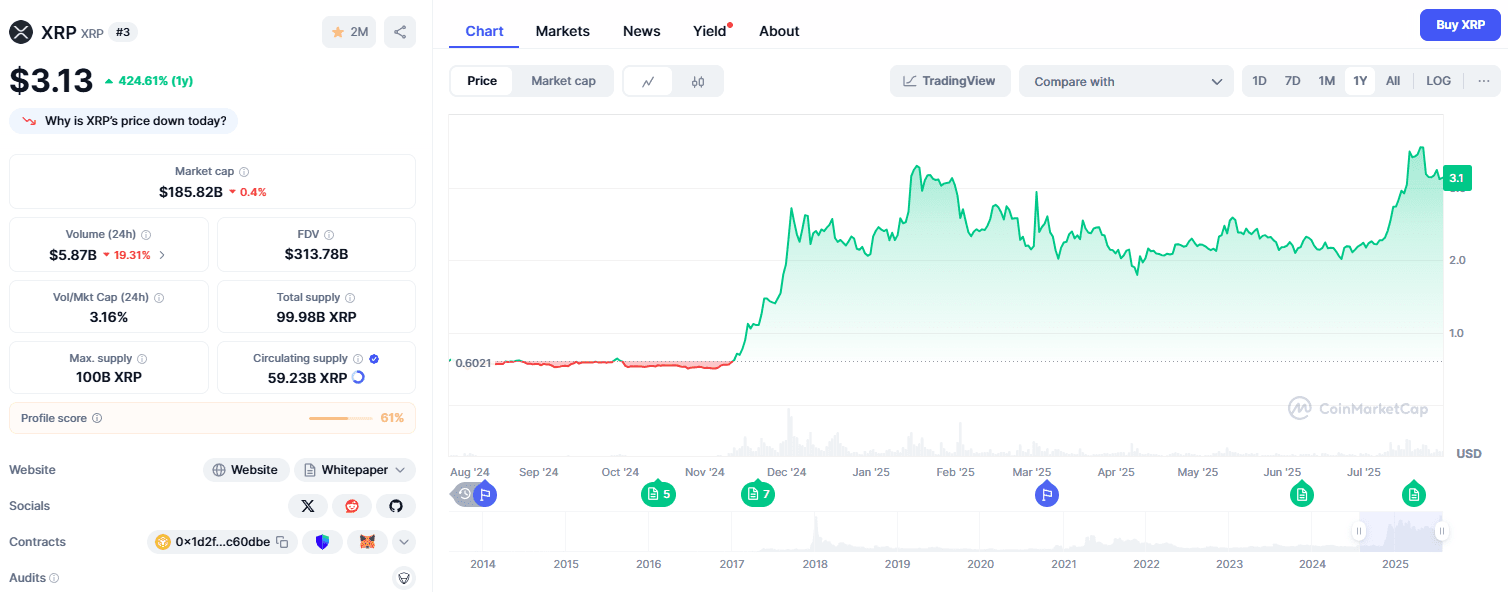

The project gained the interest of large banks and financial institutions fast. Ripple Labs was signing partnership agreements with major players, aiming to disrupt the transfer of money across the world. XRP's price experienced significant jumps in 2017 and early 2018, establishing all-time highs, but also experienced profound corrections since then.

How XRP Works: Key Technology and Principles

XRP is built on the XRP Ledger, an open, decentralized, blockchain-like protocol. Unlike Bitcoin or Ethereum, driven by energy-intensive mining, XRP is driven by a consensus protocol. High-velocity transactions are facilitated, and fees are lower. Verification of a transaction is accomplished in a matter of seconds, and the fee is a part of a cent.

RippleNet, the Ripple Labs-created network, settles cross-border payments in real time using XRP. The fundamental ideals here are speed, reliability, and low cost. These characteristics have stirred interest among banks, payment service providers, and remittance firms.

For insights into participating in the XRP ecosystem, including staking mechanics, see the XRP Staking Guide on Cryptogeek.

Notable Parties and Entities Collaborating with XRP

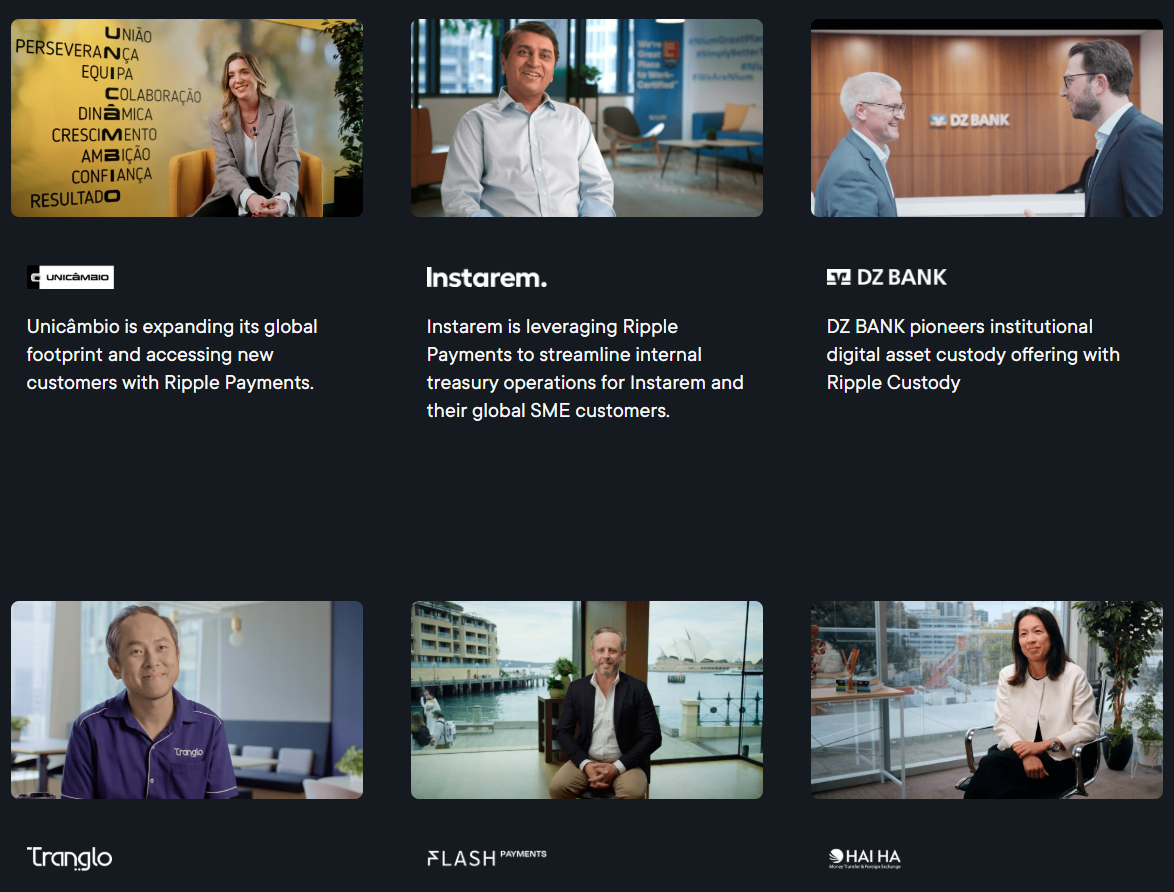

Ripple Labs remains the main company behind XRP, but the network includes a broader set of partners. Some of the largest names associated with RippleNet have included Santander, American Express, SBI Holdings, and PNC Bank. While not all partners use XRP directly, Ripple’s expanding ecosystem keeps XRP in the spotlight.

Besides Ripple Labs, other parties and commercial enterprises are building on the XRP Ledgr. For detailed listings of platforms where XRP is exchanged, see Where to Exchange Ripple guide on Cryptogeek.

XRP’s fate is also tied to key regulatory bodies, especially in the United States. The Securities and Exchange Commission (SEC) lawsuit against Ripple Labs has been a major obstacle. The outcome of this legal battle could significantly influence XRP’s future trajectory.

Significant Events Driving XRP's Price and Adoption

Several factors could trigger an XRP explosion. Here are a few major catalysts:

Legal Certainty: The pending case against the SEC has held back certain institutional investors. A definitive outcome - particularly if favorable for Ripple - would shortly draw in new enthusiasm and investment.

Global Partnerships: Continued growth in RippleNet partnerships, especially if major banks or central banks start using XRP for settlements, could drive demand.

Crypto Market Cycles: Like all cryptocurrencies, XRP’s price often follows broader market trends. Bull markets can lead to sharp rises in price, while bearish conditions can hold it back.

Real-world examples are the sudden price spike in the later part of 2017 when the price of XRP shot up with Bitcoin and Ethereum in the midst of a large crypto bull run. Recently, the short-term price rises that resulted from favorable SEC lawsuit news prove how XRP is so sensitive to news and sentiment.

Studies and Forecasting: What the Experts Say?

There are plenty of predictions for the price of XRP. There are those that assume that a favorable legal ruling and increased adoption would spur strong price appreciation, potentially back to or even beyond previous highs. Others warn that increasing competition among other coins and ongoing regulatory threats would put the brakes on XRP's prospects.

For comparison with similar tokens like Tron, check Ripple vs Tron comparison on Cryptogeek.

Academic research and financial studies often point to the importance of regulatory clarity, technological adoption, and macroeconomic trends in shaping XRP’s future. It’s also worth noting that price forecasts in crypto are often speculative and should be taken with caution.

What Needs to Happen for XRP to ‘Explode’?

To answer "when will XRP explode," we need to identify what would trigger such an event:

Resolution of Legal Issues: A clear and favorable outcome in the SEC case would open the doors for institutional adoption and exchanges to relist XRP, increasing liquidity and demand.

Financial Institution Mass Adoption: With key banks employing XRP for actual real-cross-border settlements, the demand may significantly spike.

Improved Sentiment and Market Conditions: Bullish sentiment across the crypto market tends to lift all coins, including XRP.

Integration into New Payment Systems: Adoption by new digital payment networks or central bank digital currency (CBDC) pilots could further boost demand.

Without these catalysts, it’s unlikely that XRP will see an explosive rise in the near term.

Risks and Challenges of XRP

Notwithstanding its promise, XRP is not risk-free. The following are the major concerns:

Regulatory Uncertainty: Ongoing legal problems in the United States and other markets may limit growth and bring volatility.

Competition: New cryptocoins and stablecoins are competing in the same use cases, like cross-border payments.

Market Sentiment: Crypto markets are notoriously volatile. Negative news or broader market downturns can limit XRP’s growth, even with strong fundamentals.

Investors should always weigh these risks before making decisions.

The Community and Ecosystem Surrounding XRP

XRP has one of the most passionate and vocal communities in crypto. The so-called "XRP Army" continues to advocate for the asset, promoting its use and pushing for broader adoption. Ripple’s developer grants, hackathons, and partnerships help keep the ecosystem active.

Besides Ripple Labs, other independent parties and commercial enterprises are also building on the XRP Ledger, to its own advantage in the case of long-term viability and scalability.

Conclusion

So, when will XRP explode? The solution will be dependent on a combination of legal, technical, and market conditions. A successful legal ruling, major institutional adoption, and favorable crypto market could catalyze explosive increases. But regulatory risk and competition are definite concerns. XRP's near future, for the time being, appears contingent on both its legal prognosis and its ultimate acquisition of real-world traction within the global payment infrastructure.

The answer to when XRP will explode is not a definitive date or forecast. It will be based upon a multifaceted combination of legal clarity, adoption rates, technology, and larger market conditions. Anyone considering XRP should remain informed and make informed choices.

Staying updated, being abreast of major developments, and being cognizant of the risks are necessary for every individual interested in XRP.

FAQ:

What is the main use case for XRP?

XRP is mainly used for fast, low-cost cross-border payments, serving as a bridge currency for international money transfers.

How does the SEC lawsuit impact XRP's price?

The lawsuit has prompted delistings from several exchanges and limited U.S. investor exposure, taking XRP's price down. A favorable ruling could see the price skyrocket.

Can XRP reach its all-time high again?

That is possible if certain fundamental legal, adoption, and market conditions prevail. But that is not guaranteed and is dependent on several factors.

Decentralized is XRP

XRP is powered by the XRP Ledger, and the consensus algorithm is not the proof-of-work algorithm used in Bitcoin-like blockchains. Some are critical of it being less decentralized, but they praise the speed of the algorithm.

What are the biggest risks of XRP investment?

These key risks encompass regulatory uncertainty, competition from rival projects, and volatility of the general crypto market.

Where can I buy and store XRP?

XRP can be bought on multiple overseas exchanges, but not all U.S. exchanges. It is also storable in digital purses that are XRP Ledger compatible.