XRP (XRP) Staking Guide

In the ever-evolving world of cryptocurrency, XRP stands out as a digital asset with a unique proposition and a history that has captured the attention of investors and technologists alike. This XRP (XRP) Staking Guide aims to demystify the process of staking XRP, highlighting the platforms where you can stake this coin, the steps involved in staking, and the distinctive features of these platforms. Additionally, we will delve into a description of XRP, the history of the project, and the innovative technology it is built upon.

Understanding XRP and Its Ecosystem

A Brief History of XRP

XRP was created by Ripple Labs Inc., a technology company aiming to revolutionize global finance through blockchain technology. Unlike many cryptocurrencies that were designed to be decentralized digital currencies from their inception, XRP was conceived as a bridge currency in international transactions, offering a faster, more efficient alternative to traditional banking systems. Its consensus ledger is unique, not requiring mining like Bitcoin or Ethereum, which makes it more environmentally friendly and efficient in processing transactions.

The Technology Behind XRP

The XRP Ledger (XRPL) is an open-source, decentralized blockchain technology that provides significant advantages in terms of speed, cost, and scalability. Transactions on the XRPL can be settled in seconds at a fraction of the cost of traditional banking transactions or even other blockchain networks. This efficiency is a result of the consensus protocol used by the XRPL, which does not rely on the energy-intensive proof-of-work system.

Staking XRP: An Overview

Traditionally, XRP is not staked in the same manner as coins on proof-of-stake (PoS) blockchains. However, the evolving crypto ecosystem has introduced innovative ways to earn rewards on your XRP holdings, including through certain platforms that offer staking-like services or yield opportunities through XRP-based products.

Platforms for Staking XRP

When looking to grow your XRP holdings through staking, it's crucial to select platforms that are reputable and offer clear, user-friendly staking mechanisms. Here are some platforms where you can effectively stake XRP or engage in activities that yield returns on your XRP investment:

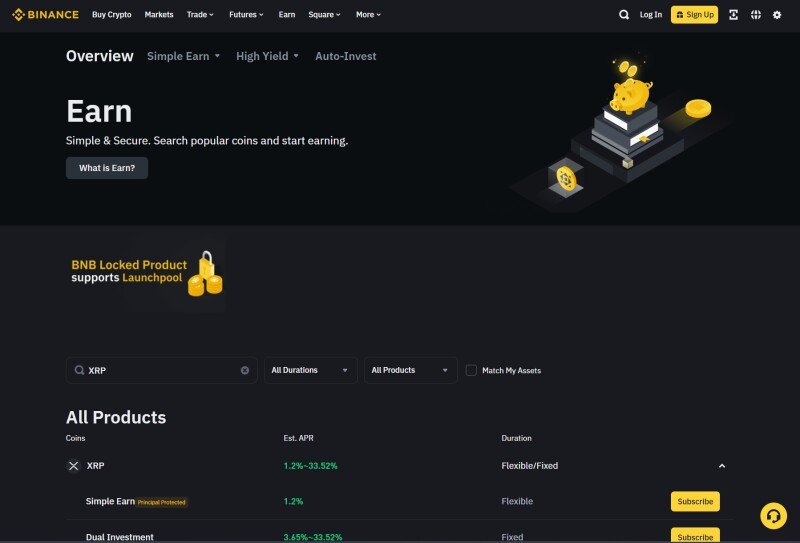

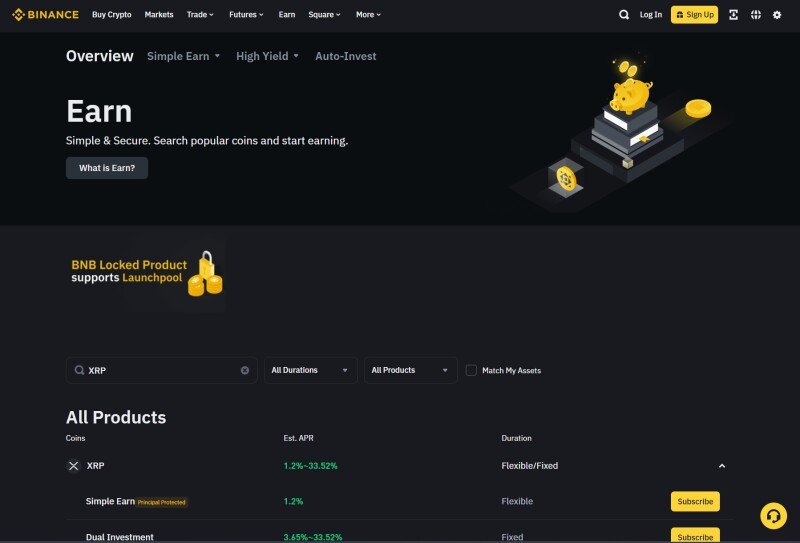

- Binance Earn: Binance, one of the world's leading cryptocurrency exchanges, offers various products under its Binance Earn suite, where users can stake XRP to earn rewards. The platform is known for its security, user-friendly interface, and competitive staking rewards.

- Crypto.com: Another popular choice for XRP holders, Crypto.com provides a platform where users can stake XRP among other cryptocurrencies to earn interest. Their staking products are flexible, offering various terms and interest rates to suit different investor needs.

- Nexo: Nexo allows XRP holders to earn interest on their cryptocurrency, operating similarly to a savings account for your digital assets. While not staking in the traditional sense, it provides a means to generate passive income from your XRP holdings.

The Process of Staking XRP

The process of staking XRP or earning rewards on your XRP holdings generally involves the following steps, though specifics may vary depending on the platform:

- Select a Platform: Choose a reputable platform that offers staking services or interest accounts for XRP. Consider factors like security, ease of use, and the rewards rate.

- Deposit XRP: Transfer your XRP to the platform. This typically involves sending your XRP from a wallet or another exchange to your account on the staking platform.

- Choose a Staking Option: Many platforms offer different staking options, including locked terms or flexible staking. Select the one that best fits your investment strategy.

- Start Earning Rewards: Once staked, your XRP will begin earning rewards based on the platform's specific mechanisms and rates. These rewards can often be compounded or reinvested to enhance yield.

Main Features of Staking Platforms

When evaluating platforms for staking XRP, consider the following key features:

- Security: The platform's security measures are paramount. Look for platforms with a strong track record of security and user fund protection.

- Yield Rates: Compare the interest rates or yield rates offered by different platforms. Higher rates can lead to more significant earnings on your staked XRP.

- Flexibility: Some investors prefer platforms that offer flexible staking options, allowing for withdrawal of funds without penalties. Others may seek higher rewards through fixed-term staking.

- User Experience: A platform's ease of use can greatly affect your staking experience. User-friendly interfaces and clear instructions are essential for a hassle-free staking process.

As we delve deeper into the specifics of XRP staking and the platforms that facilitate it, we aim to provide a clear, comprehensive guide to help you make informed decisions about how to best leverage your XRP holdings. Staking XRP can be an excellent way to generate passive income while supporting the broader ecosystem of one of the most intriguing projects in the cryptocurrency space.

Continuing from where we left off, let's explore more about the nuances of staking XRP, including how to maximize your returns and understand the risks involved. Additionally, we will touch upon the future potential of XRP staking and how it fits into the broader context of digital asset management.

Maximizing Returns from XRP Staking

To maximize returns from staking XRP, consider these strategies:

- Diversify Across Platforms: Don't put all your XRP in one platform. By diversifying across different platforms, you can capitalize on the best rates and reduce risk.

- Reinvest Rewards: Many platforms offer the option to automatically reinvest your staking rewards, compounding your earnings over time.

- Stay Informed: The staking landscape is constantly evolving. Stay informed about new platforms, updated rates, and changes in terms and conditions.

Understanding the Risks

While staking XRP offers a way to earn passive income, it's not without its risks. Here are a few to consider:

- Platform Risk: The security and solvency of the platform where you stake your XRP can impact your investment. Always research a platform's reputation and security measures.

- Market Volatility: The value of XRP, like all cryptocurrencies, can be highly volatile. Changes in market conditions can affect the value of your staked assets and the returns you receive.

- Liquidity Risk: Depending on the staking terms, your XRP may be locked up for a period, affecting your ability to sell during market fluctuations.

Staking XRP: Part of a Broader Digital Asset Strategy

Staking XRP should be considered a component of a broader digital asset management strategy. It's essential to balance staking activities with other investment approaches, such as holding a diversified portfolio of cryptocurrencies, participating in DeFi projects, or exploring other yield-generating opportunities within the crypto space.

Conclusion

Staking XRP offers cryptocurrency investors a unique opportunity to earn passive income on their holdings. By carefully selecting platforms, understanding the associated risks, and employing strategies to maximize returns, investors can effectively leverage their XRP to generate additional revenue. As the cryptocurrency landscape continues to evolve, staying informed and adaptable will be key to success in staking and beyond.

Staking XRP is not just about earning rewards; it's about participating in the growth and security of the XRP Ledger. As the ecosystem develops and new technologies emerge, the possibilities for XRP staking and its role in digital asset management will continue to expand, offering exciting opportunities for investors willing to explore the frontiers of cryptocurrency.

यहाँ अभी तक कोई टिप्पणी नहीं है। पहले रहो!