Guardian (GUARD) Review: Exploring the Project's Vision and Technology

In this Guardian Coin review, we will be taking a close look at what the project is all about, how the tech works, and whether it plays a meaningful role in the existing crypto scene. Guardian Coin is part of a set of blockchain token projects that are designed with a mission for community security, transparency, or responsible finance. While the specifics of each of the “guardian” projects will vary, the token proposed is, in general, trying to be an emblem of confidence, security, and decentralised responsibility. But how does it hold up when subjected to actual scrutiny?

Contents

What is Guardian Coin?

Guardian Coin is a blockchain project that is developing a security-centric utility token. The token's basic promise is a more open, safe environment for peer-to-peer transactions, token governance, and possible real-world integrations in social safety, digital identity, or anti-fraud tech.

Although Guardian Coin appears to be a niche project, the project gained popularity within the crypto community that values community-driven ecosystems and community-built utilities that are intended to enable ethical blockchain use.

It would cover the following, amongst others, depending on the actual version because there are projects that have the same titles:

- Anti-scam devices

- DAO community governance

- Secure token transfers

- Partnerships with non-profit or charitable institutions

The official website is the go-to source of information, but always refer to the blockchain explorers and community forums for the most up-to-date information.

Technology of Guardian Coin

The Guardian Coin is founded on a blockchain platform that enables people to send, store, and deal with tokens safely and reliably. The cryptocurrency is developed using Ethereum (ERC-20), Binance Smart Chain (BEP-20), or a custom chain, depending on the project's architecture.

Typical core tech specs often include:

- Smart contract security with automated protocols restricting risks like rug pulls or unauthorized token transfers.

- Transparent governance: A voting mechanism that enables token holders to vote for project decisions.

- Low costs of gas: When used on such platforms as Polygon or BSC, the transaction fees are low.

Guardian tokens could also have time-locked functions, anti-whale functions, or community audit functions in an effort to gain greater user confidence and avoid manipulation.

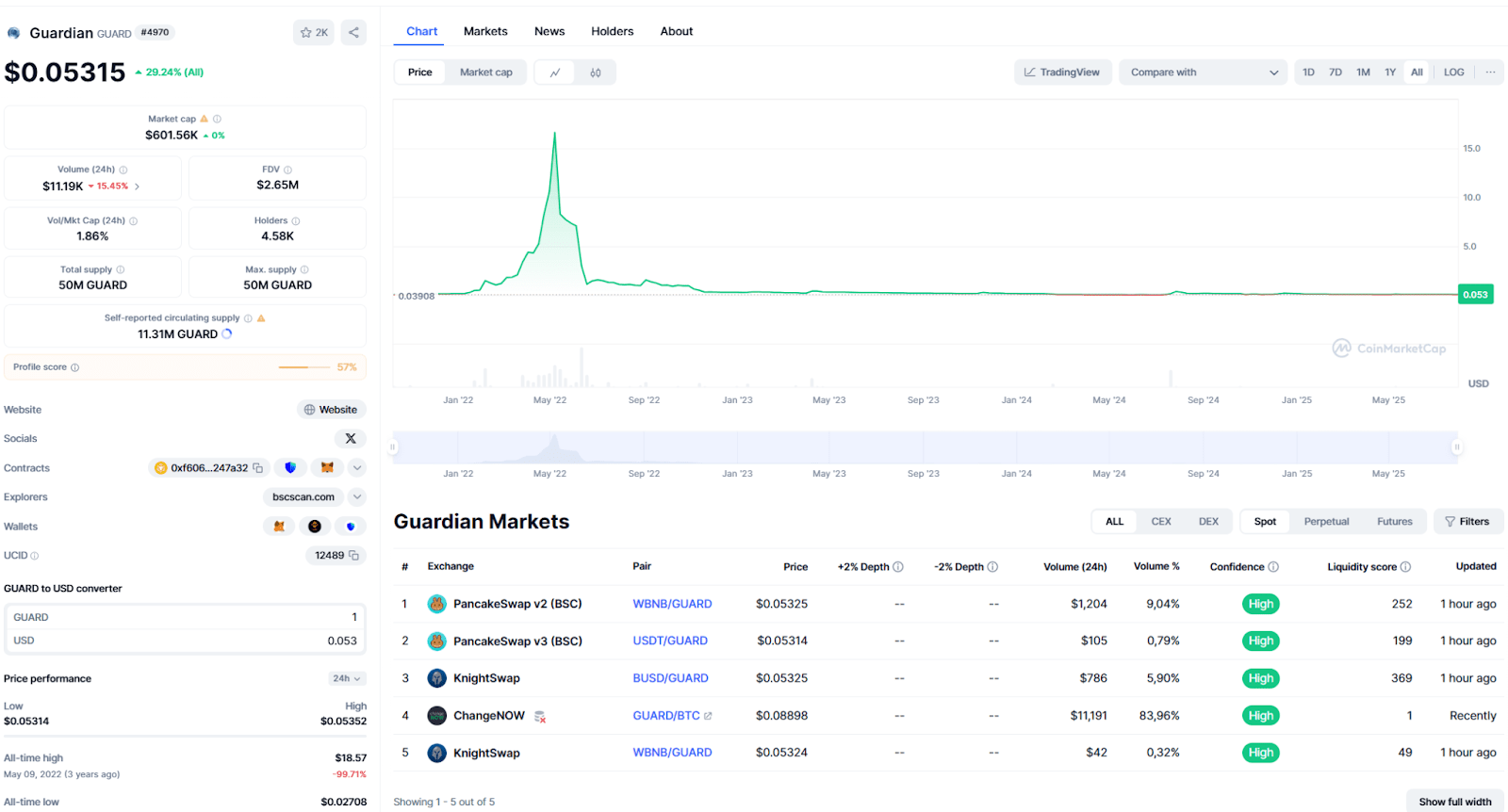

Tokenomics and Token Structure

Most Guardian Coin is of deflationary or limited-supply variety, often for the longer-term health of the project. Rough numbers will of course vary, but typical tokenomics could include:

- Total Supply Cap: A fixed number of tokens, most commonly in the hundreds of millions or low billions.

- Burn Mechanism: A part of the transaction fees or the project profits will be dedicated to token burning.

- Staking Rewards: Opsyfi offers the opportunity for passive income for long-term holders in the form of staking their tokens in a smart contract.

Fair token allotment is necessary for legitimacy. A balanced mix throughout developmental, marketing, community rewards, and liquidity pools is generally received favorably.

Community and Governance

Community is also the core of the majority of Guardian Coin projects. In their design, such systems are meant to give the individual project user greater power and reduce their need for centralized guidance.

Common governance features include:

- Proposal submission: Token holders can propose changes in the project's roadmap or the funding allocation.

- Right to vote: The worth of each vote is directly proportional to the number of tokens held.

- Treasury management: Some Guardian DAOs employ the use of a shared wallet in funding future development, voted on by the community.

Active communities on Telegram, Discord, and Twitter are good indicators of a strong project core, particularly if team members are constantly discussing and engaging in feedback loops.

Use Cases and Real-World Applications

So what is actually possible with Guardian Coin? That is dependent on the direction of the developers. Some of the probable use cases are:

- SafeToken Swaps: Protecting the user from scam tokens or malicious smart contracts.

- Identity Verification Technology: Providing for decentralized identities that verify but do not collect excessive information.

- Donations for Charity: Enabling donations to registered charities with transparency through blockchain.

- Crowdfunding Sites: Serving as the native token for the projects' safe funding and release milestones.

These practical integrations are the secret to the token's long-term viability. Tokens that are unable to transcend simple transactions tend to fail in retaining value or interest in the long run.

Strategic Alliances and Ecosystem Growth

The viability of Guardian Coin also hinges on what it is affiliated with. Aligning with other DeFi projects, NFT projects, payment systems, or even public agencies could provide legitimacy.

For example:

- A cooperation with a provider that provides KYC would facilitate user verification.

- Interoperability via a DEX or wallet service could increase exposure and transaction volume.

- Public safety or non-profit organizations could relate to the “guardian” branding.

Genuine partnership should always be verifiable on-chain or announced through official channels. Community hype isn’t the guarantee of functionality.

Transparency in Projects and Team Identity

Transparency is of key concern in the cryptocurrency space. There are several successful Guardian projects that provide:

- Public team profiles or audit reports

- Roadmaps with definite objective specifications

- Regular blog posts, AMAs, or commits on GitHub

Not all anonymous teams are bad, but when they go alongside obscure tokenomics or no tech roadmap, they become suspicious.

Risks and Considerations

All of the cryptocurrency investments are high-risk, as is the Guardian Coin. The following are some to keep in mind:

- Market Volatility: As with most altcoins, the price movements are swift and drastic.

- Low Liquidity: Cryptos that are listed on small DEXs may be harder to buy or sell in large amounts.

- Speculative Hype: Ads for non-functional products build expectations but provide no real value.

- Lack of Regulation: If the token promises security services, legal clarity is crucial to avoid enforcement issues.

A clear whitepaper, working demonstration, and community activity proof would reduce uncertainty.

Conclusion

Guardian Coin is a fascinating case study of a safety-, transparency-, and ethics-driven crypto project. Whether it is a good investment or not is dependent on whichever version you are considering, how active the developmental work is, and how well the project delivers on promises.

If you're after a community-driven project that has practical safety and trust tools, then Guardian Coin is worth considering. As is the case with all altcoins, though, look beyond hype and heed use case, liquidity, team evolution, and long-term vision before investing.

FAQ

What is Guardian Coin used for?

Secure transactions, community governance, anti-fraud systems, or charity-based payments are all of the potential uses that Guardian Coin could be implemented for.

Is Guardian Coin based on Ethereum?

A number of the Guardian Coin versions are ERC-20 tokens, but others are on Binance Smart Chain or their own chain. Always check the contract address and the blockchain explorer.

Can you stake Guardian Coin?

The majority of Guardian tokens offer staking through smart contracts or DEXs. Passive income is enabled for the token holders, but the compensation is unpredictable.

Is the project audited?

A few iterations of Guardian Coin have been through smart contract audits. Always verify the status of the audit on the official website or GitHub.

How do you buy Guardian Coin?

Decentralized exchanges like Uniswap or PancakeSwap, or in a few cases, small centralized exchanges, may trade Guardian Coin. Please make sure to use the correct contract address in order to avoid scams.

Is Guardian Coin a Secure Investment Platform?

No crypto asset is fully safe. Guardian Coin’s safety depends on smart contract quality, tokenomics, team transparency, and market dynamics.

यहाँ अभी तक कोई समीक्षा नहीं है। पहले रहो!