Is Solana a Good Investment? Expert Analysis and Insights

"Is Solana a good investment?" is a critical question for anyone exploring cryptocurrencies. Solana (SOL) has swiftly become one of the most discussed blockchain platforms, gaining popularity for its speed and affordability. This article dives deep into Solana's core technology, historical performance, real-world applications, and key factors you should consider before investing.

Contents

- Understanding Solana: A Quick Overview

- Historical Performance of Solana

- Solana's Unique Technology: Proof of History

- Real-World Applications of Solana

- Key Players and Projects on Solana

- Analyzing Solana's Risks and Challenges

- Investment Prospects and Analyst Opinions

- Conclusion: Is Solana a Good Investment?

- FAQ Section

Understanding Solana: A Quick Overview

Solana is a decentralized blockchain platform designed to support fast and low-cost transactions. It aims to solve common blockchain issues like slow transaction speeds and high fees. Founded in 2017 by Anatoly Yakovenko, Solana utilizes a unique consensus mechanism called Proof of History (PoH), which significantly increases the network's speed and efficiency compared to competitors like Ethereum and Bitcoin.

The SOL token is the native cryptocurrency of the Solana network, used primarily to pay for transaction fees and participate in network governance.

Historical Performance of Solana

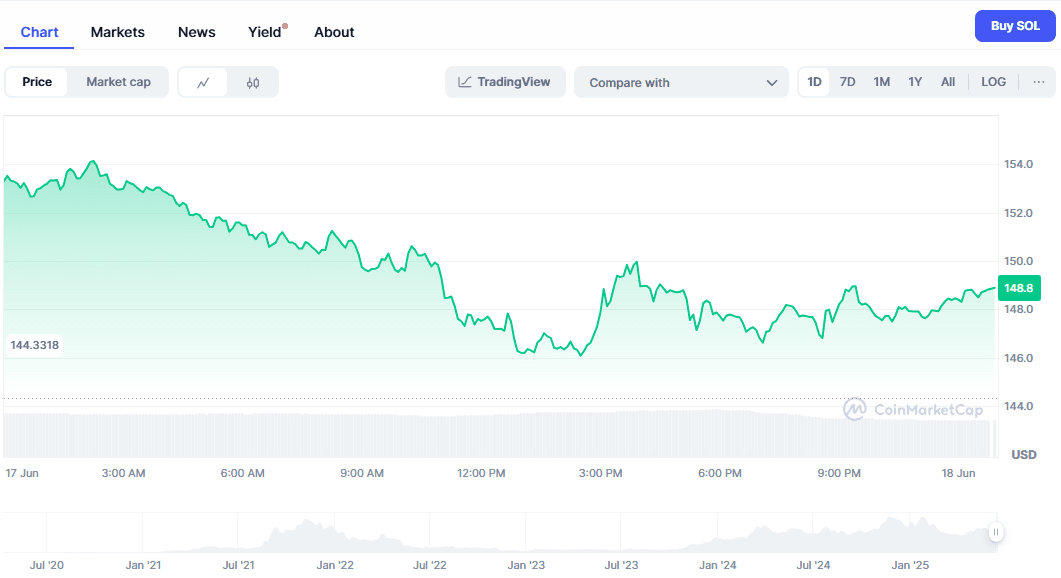

Solana launched its mainnet in March 2020, quickly gaining traction due to its performance capabilities. In 2021, SOL surged dramatically, hitting an all-time high of around $260 in November. This rise was driven by the broader crypto market boom and growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs).

However, like other cryptocurrencies, SOL experienced significant volatility. Its value sharply declined during the crypto downturn of 2022. These fluctuations highlight the inherent risk in cryptocurrency investments, emphasizing the importance of thorough research.

Solana's Unique Technology: Proof of History

Solana stands out mainly because of its innovative Proof of History technology. Unlike traditional blockchains relying solely on Proof of Work (PoW) or Proof of Stake (PoS), PoH adds a time-stamping mechanism that helps verify transactions rapidly.

This method allows Solana to process thousands of transactions per second (TPS), significantly higher than Ethereum's average TPS of 15-30. This speed positions Solana as a leading choice for high-volume applications, making it attractive to developers and businesses needing fast and reliable blockchain solutions.

Real-World Applications of Solana

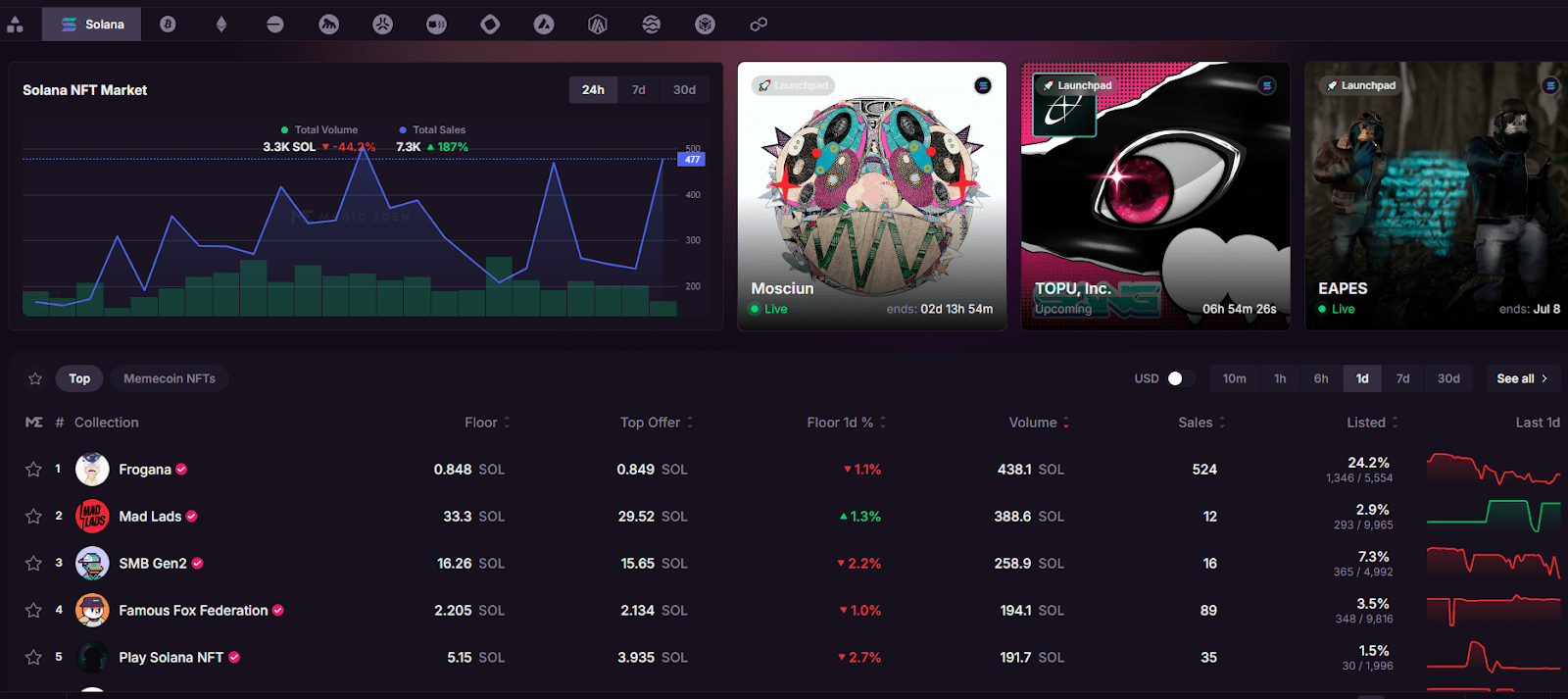

Solana's speed and affordability have attracted various real-world applications, especially in the DeFi and NFT spaces. Prominent DeFi platforms, such as Serum and Raydium, have chosen Solana for its scalability and low transaction costs.

NFT marketplaces like Magic Eden have also flourished on Solana due to cheaper minting and trading fees compared to Ethereum. Additionally, Solana is making strides in gaming and decentralized applications (dApps), further demonstrating its versatility.

Key Players and Projects on Solana

Several influential companies and projects support Solana's ecosystem. Serum, founded by Sam Bankman-Fried, the former CEO of FTX, is a decentralized exchange (DEX) built on Solana, facilitating fast and low-cost crypto trading.

Magic Eden, a leading NFT marketplace, leverages Solana to offer quick and affordable NFT minting and trading. Other notable projects include Star Atlas, a popular blockchain-based game, and Phantom Wallet, a widely-used Solana wallet praised for its ease of use and security.

Analyzing Solana's Risks and Challenges

Investing in Solana also involves risks. Network outages have occasionally plagued Solana, raising concerns about its reliability. Several outages in 2021 and 2022 temporarily halted transactions, impacting user confidence.

Additionally, competition from other scalable blockchains like Avalanche, Cardano, and Ethereum 2.0 poses challenges. Investors should closely monitor how Solana addresses these technical issues and competitive pressures.

If you are interested in staking SOL and want to learn about its risks and rewards, you can read Solana (SOL) Staking Guide on staking.cryptogeek.info.

Investment Prospects and Analyst Opinions

Many analysts remain cautiously optimistic about Solana's long-term potential, citing its impressive speed, low transaction fees, and strong developer community as positive indicators. Crypto experts often highlight Solana’s potential to grow significantly, particularly as blockchain adoption continues to expand globally.

However, they also caution about volatility and recommend diversifying investments rather than solely focusing on SOL. For instance, a report by cryptocurrency analytics firm Messari noted Solana’s strong fundamentals but emphasized caution due to recurring technical issues and market competition.

Conclusion: Is Solana a Good Investment?

Determining if Solana is a good investment depends on your risk tolerance, investment goals, and market conditions. Its technological strengths and growing ecosystem provide solid reasons to consider it seriously. However, potential investors must also weigh the risks related to network reliability and competition.

Careful analysis and thoughtful consideration of both Solana’s strengths and vulnerabilities will help investors make informed decisions aligned with their financial objectives.

FAQ Section

What makes Solana different from other blockchains?

Solana's main difference lies in its unique Proof of History consensus mechanism, significantly boosting transaction speed and reducing costs compared to Ethereum or Bitcoin.

Has Solana experienced any technical problems?

Yes, Solana has encountered several network outages, temporarily halting transactions. These outages pose reliability concerns that investors should consider.

Is Solana good for NFTs?

Solana has become popular for NFTs because of its low fees and fast transactions. Platforms like Magic Eden have benefited significantly from these advantages.

Can Solana compete with Ethereum long-term?

Solana can potentially compete with Ethereum, especially given its speed and cost benefits. However, Ethereum’s broad adoption and ongoing upgrades (Ethereum 2.0) present competitive challenges.

Should I diversify or invest heavily in Solana?

It’s usually wise to diversify investments. While Solana has promising aspects, its volatility and risks mean investing only a portion of your portfolio in SOL could be a safer approach.

शीर्ष ट्यूटोरियल

-

Что такое хард-форк?Jul 27, 2020

-

Стейкинг на Ethereum 2.0 и его основные особенностиAug 01, 2020

-

Инновации на основе блокчейна в сфере энергетикиAug 03, 2020

यहाँ अभी तक कोई टिप्पणी नहीं है। पहले रहो!