USD Coin (USDC) Staking Guide

USD Coin (USDC) Staking Guide: Maximizing Earnings with Stability

In the fast-paced world of cryptocurrency, USD Coin (USDC) offers a beacon of stability, providing an essential bridge between the volatile crypto markets and the predictable world of traditional fiat currency. This comprehensive USD Coin (USDC) Staking Guide is designed to navigate you through the intricacies of USDC staking, delineating the platforms that facilitate this process, the methodologies they employ, and the unique features they offer. Additionally, we will delve into the essence of USDC, its developmental chronology, and the technological infrastructure that underpins it, furnishing you with a holistic perspective on USDC staking.

Introduction to USD Coin (USDC)

USD Coin stands as a paradigm of trust and stability in the cryptocurrency domain, classified under the category of stablecoins—digital currencies pegged to a stable asset like the US dollar. Engineered for a 1:1 value ratio with USD, USDC mitigates the inherent volatility of the crypto markets, offering a safe haven for investors and traders alike.

Historical Insight and Technological Foundation

Launched in September 2018 through a collaboration between Circle and Coinbase, USDC was conceived to meld the flexibility and efficiency of cryptocurrency with the stability and reliability of fiat currency. Operating predominantly on the Ethereum blockchain, USDC leverages the security and interoperability of Ethereum, ensuring seamless integration across a plethora of platforms and applications.

Platforms for Staking USD Coin (USDC)

Staking USDC can be an attractive proposition, offering a means to accrue earnings on holdings with reduced exposure to market volatility. Here are several platforms renowned for their USDC staking services:

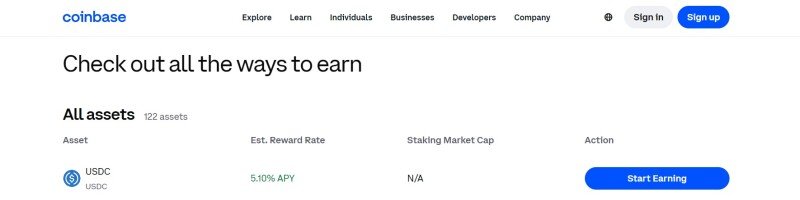

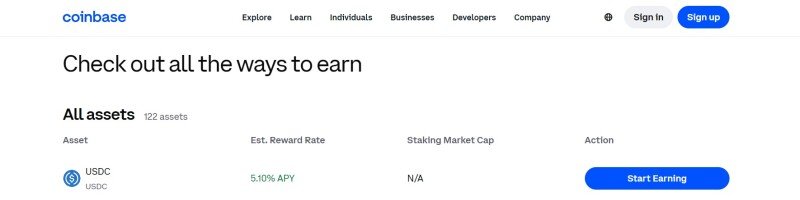

- Coinbase: As a co-founder of the USDC project, Coinbase provides one of the most straightforward and secure avenues for staking USDC, offering competitive yields and an intuitive user interface.

- BlockFi: Specializing in crypto financial services, BlockFi allows users to earn interest on their USDC deposits, featuring a user-friendly platform and competitive interest rates.

- Crypto.com: Offering a versatile suite of crypto services, Crypto.com includes USDC staking within its Earn program, providing various terms and interest rates to cater to diverse investor preferences.

Navigating the Staking Process

While the staking process can vary across platforms, it typically encompasses the following steps:

- Platform Selection: Evaluate and select a staking platform based on factors like security, interest rates, and user experience.

- USDC Acquisition: Ensure you have a sufficient USDC balance for staking. USDC can be purchased on numerous exchanges or directly through some staking platforms.

- Initiating Staking: Deposit your USDC into the staking program on the chosen platform. You may need to select specific staking terms or lock-up periods if available.

- Interest Accumulation: Once staked, your USDC will start generating earnings based on the prevailing interest rates, which can be tracked within the platform interface.

Essential Features of USDC Staking Platforms

When embarking on USDC staking, prioritize platforms that exemplify the following characteristics:

- Robust Security: Opt for platforms with proven security credentials to ensure the safety of your staked assets.

- Transparency: Choose platforms that provide clear, upfront information about staking terms, interest rates, and any applicable fees.

- Liquidity Options: Consider platforms that offer flexible liquidity options, allowing you to access your staked USDC when needed.

- Customer Support: Reliable customer support can be invaluable, especially for resolving queries or issues that may arise during the staking process.

Economic Implications of USDC Staking

USDC staking not only offers individual financial benefits but also carries broader economic implications:

- Market Stability: By providing a stable asset for staking, USDC can help mitigate the inherent volatility of the cryptocurrency market, contributing to overall market stability.

- Liquidity Provision: Staked USDC can enhance liquidity in the crypto market, facilitating smoother transactions and more efficient market functioning.

- Mainstream Adoption: The accessibility and stability of USDC staking can attract more participants to the crypto market, including traditional investors seeking low-risk opportunities, thereby fostering broader adoption of cryptocurrencies.

Future Outlook for USDC Staking

The future of USDC staking is likely to be shaped by various factors, including technological advancements, regulatory developments, and market dynamics:

- Innovation: As blockchain technology evolves, new staking mechanisms and platforms may emerge, offering enhanced features and greater efficiency for USDC stakers.

- Regulation: Regulatory changes can impact the staking landscape, influencing platform operations, staking rewards, and market participation. Staying abreast of regulatory developments is crucial for informed staking decisions.

- Integration: The growing integration of cryptocurrencies into traditional finance may lead to new staking opportunities and applications for USDC, further embedding it into the financial ecosystem.

Conclusion

Staking USD Coin (USDC) presents a compelling opportunity to generate passive income while mitigating exposure to the whims of the crypto market. By carefully selecting a staking platform and engaging with the USDC ecosystem, you can harness the benefits of cryptocurrency alongside the stability of traditional fiat currency.

As the landscape of cryptocurrency continues to evolve, so too will the opportunities and methodologies for USDC staking, promising an ongoing avenue for earning potential amidst the broader financial innovation that characterizes the digital age.

Embark on your USDC staking journey with informed confidence, leveraging the stability of USD Coin to navigate the exciting yet unpredictable world of cryptocurrency investment.

Voici encore aucun commentaire. Soyez le premier!