Black Whale Crypto Review: All You Need to Know

Black Whale Crypto Review is the primary keyword. Black Whale Crypto Review delves into the BLK token and ecosystem in a comprehensive manner. In the review I describe what Black Whale Crypto is, how it functions, why it could be important, and respond to frequently asked questions.

Black Whale Crypto Review presents the BLK token project and the underlying concept. Black Whale Crypto operates on BNB Chain and Polygon (renamed later to xXx) and is designed to provide ETF‑style products in the DeFi arena. The review addresses the protocol, tech, background, and standing in the crypto space.

Project Description

Black Whale Crypto (BLK, later renamed xXx) members have a portfolio that entitles them to use a DeFi protocol that provides ETF‑type derivative tokens. The protocol is run on BNB Smart Chain and Polygon using smart contracts that issue tokens that mirror staking assets indexes on various platforms.

The project website introduces itself as the initial DeFi protocol that is driven by crypto ETF derivatives, in which the ETF tokens are mint-able in real time for tracking various coins or staking products. Collateral is held through stablecoins such as USDB and xXx tokens in order to maintain backing for every ETF derivative.

Technology and Mechanics

The protocol uses smart contracts to let users mint ETF derivatives by depositing collateral such as xXx or USDT. These ETF tokens are designed to reflect real assets or indexes in real time across exchanges and staking platforms.

Governance is DAO‑based, giving holders voting power over synthetic asset listings, fee structure, collateral ratios, and project launch options called PAO. The ecosystem includes features like staking, liquidity provision, Social NFTs (“Thousand Islands”), cross‑chain swaps, and a metaverse integration.

You can stake for APR rewards, add liquidity for rewards, mint synthetic tokens, or enter active income programs. The project also engages in cooperation with other projects through its DAO pool and PAO launchpad business model.

Check Best Crypto Staking Platform guide on Cryptogeek for general staking strategies and platform comparison.

History and Evolution

Black Whale started as BLK token on BNB Chain, later branched out to Polygon and rebranded to xXx. The early builds consisted of the private sale rounds (Round A, Round B), public launch, token scan, and homebred DApp release.

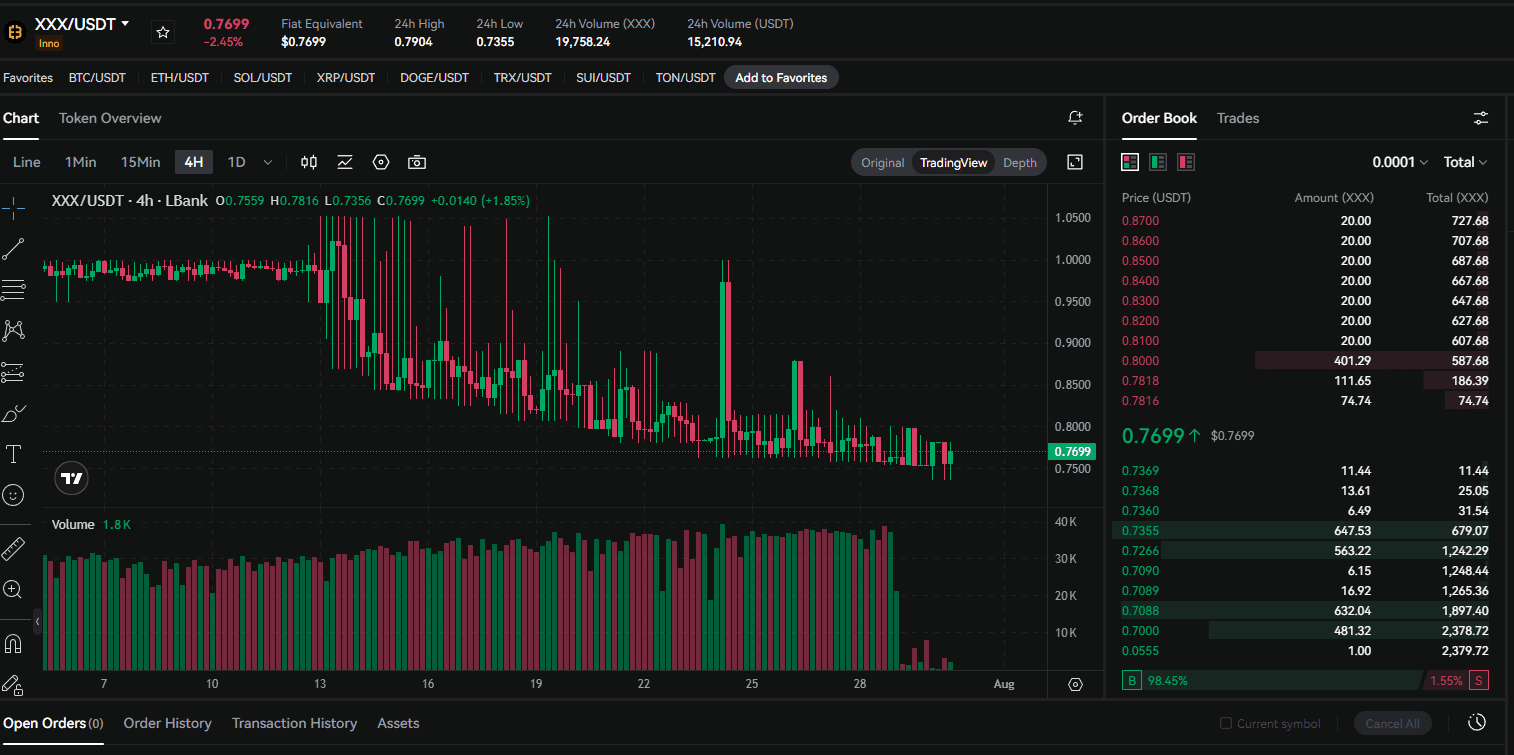

The project grew through DAO establishment (“Thousand Islands”), cross‑chain support, NFT ecosystem, GameFi partnerships, and listings on DEXs and CEXs such as LBank in 2024. It introduced multiple versions of its ETF derivative feature and launched metaverse components in phases through 2025.

Future plans encompass greater metaverse growth and possible stock exchange listing scheduled for early 2026.

Role in the Community

Black Whale seeks to occupy a niche between DeFi tokens and CeFi ETF products. With ETF on-chain derivatives, the user is able to diversify exposure in the absence of a centralized issuer. The DAO entitles the user to governance and a voice in token listings and project development.

The social NFT system, PAO launchpad, and metaverse ecosystem target a larger user set—not only traders but GameFi gamers and synthetic asset enthusiasts.

Listing on exchanges and interoperability with liquidity pools like PancakeSwap and LBank open doors for trading. Price is followed on CoinPaprika and similar sites, but actual market cap and liquidity are limited and sometimes inconsistent.

Tokenomics and Contracts

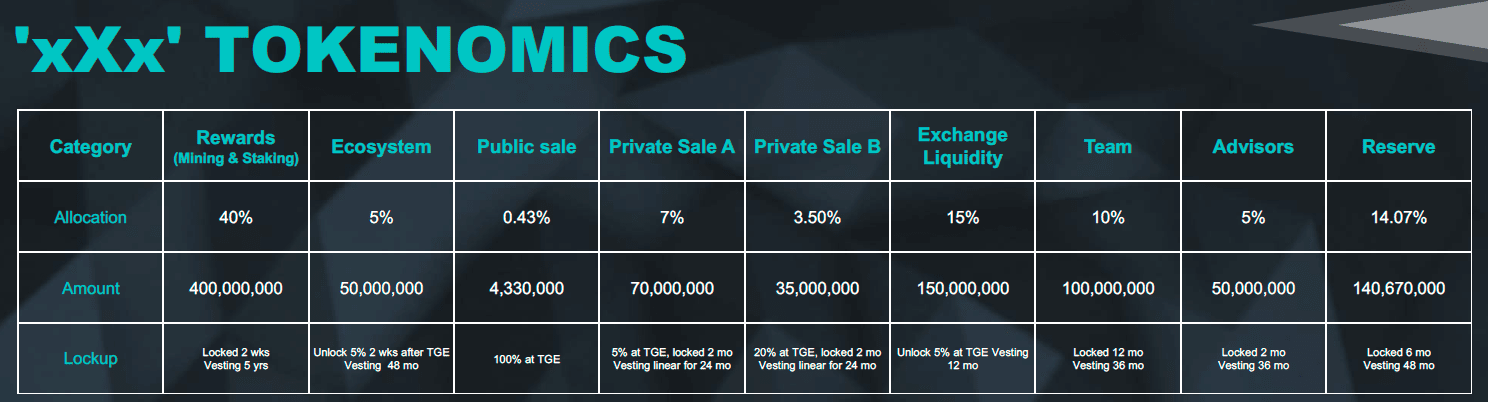

The total supply is normally limited to 600 million xXx/BLK tokens. The token allocation is for staking and mining rewards (approximately 40 %), public and private sale rounds, ecosystem, team and advisor reserve, and exchange liquidity allocation.

Lockups and vesting terms are defined over months to years in order not to overcirculate. Team tokens vest for up to 48 months, allocations for private sales release in increments, and public sale unlocks a limited amount after TGE.

The contract addresses are on BNB Chain (old BLK) and Polygon/Ethereum (xXx) and are accessible via their respective official links and verified on explorers such as BscScan and PolygonScan.

Cross‑Chain and Ecosystem Features

Black Whale enables cross-chain interactions among BNB Chain and Polygon, allowing for user interactions on multiple networks simultaneously while minting ETF tokens that follow assets throughout the world of DApps.

The metaverse (“Island”) and GameFi collaborations are designed to provide utility besides finance. Participants are able to generate revenue, vote for listings (through PAO), stake NFTs, and venture into virtual spaces associated with the project. This makes entry smoother for non‑traders and widens use cases for the ecosystem.

Risks and Transparency

Market data has been incongruent—some of the exchanges are quoting extremely low or zero price, zero circulating supply, or undefined team profiles, and that does not make the user able to estimate actual liquidity and adoption.

As with all DeFi experiments, the user is left open to smart contract risk, low liquidity risk, and market volatility. The DAO and collateral mechanisms try to introduce greater transparency, but the user should scrutinize whitepaper documentation, contract audits, and fee models himself.

Conclusion

Black Whale Crypto Review is an overview of a DeFi token and platform designed with on-chain ETF derivatives, cross-chain asset tracking, and social NFTs. The platform integrates governance, staking, liquidity, synthetic products, and metaverse interaction. The project has evolved in stages, but the data is scattered, and the price reporting is not clear. Potential users should approach with caution, read the documentation, and look out for risks.

For insights into staking trends and staking platform analysis, refer to the main Cryptogeek Staking section.

FAQ

What is Black Whale Crypto (BLK)?

t is a DeFi asset management protocol that lets users mint ETF‑style derivatives on BNB Chain and Polygon. These tokens track indexes or staking products in real time, collateralized by xXx or stablecoins.

How does the ETF derivative minting work?

Participants put in collateral (USDT or xXx), after which smart contracts issue tokens associated with asset indexes. Tokens are supported and redeemable or transferable. The protocol tries to reveal the actual assets and keep the collateral levels steady.

Does the community vote on project decisions?

Yes. The governance is handled through DAO. Asset listings, models of fees, levels of collateral, PAO launchpads, and others are voted on by token holders.

Is Black Whale safe to use?

Safety relies on code audits, liquidity, and the governance mechanisms of the protocol. Liquidity and token distribution data are, at times, inconsistent on trackers. Always check for contract audits and begin small.

How does someone purchase BLK or xXx?

You must use crypto such as BNB or USDT. The transaction is done on supported DEXs (e.g., PancakeSwap on BNB Chain) or CEXs such as LBank listing (XXX/USDT). Set up MetaMask, input contract address if necessary, and swap collateral tokens for BLK/xXx.

The token quantity and allocation is as follows.

The maximum total supply is about 600 million tokens. The allocations are rewards, public and private sale, ecosystem, team, advisors, and liquidity. Vesting takes months to years to avoid dumps.

Why is the price data so variable?

Market trackers relay varying live data. Some will relay zero circulating supply or zero price, and that could be indicative of low volume of trades, low accuracy of signals, or latency in updates. Always crosscheck through multiple sources and contract explorers.

Il n'y a pas encore d'avis. Soyez le premier.